In 2006, concrete floor laying specialist Somero Enterprises was flipped back onto the AIM market by its private equity owners.

During its short period of private ownership, Somero’s balance sheet had been loaded up with net debt of about $20m. At the same time, western economies were hurtling with eyes closed towards the biggest financial crisis since 1929.

The result was inevitable. Somero came close to insolvency, but just managed to survive. The group has since repaired its balance sheet and benefited from the cyclical upturn. Somero shares have risen by 850% over the last five years and offer a bulletproof dividend.

Yet as shareholders will have noticed, Somero’s share price has fallen by 20% since hitting a post-2007 high in June. The shares have now given up all of this year’s gains. Concerns over the China-led emerging market slowdown are probably to blame, as are fears that the market may be approaching a cyclical peak.

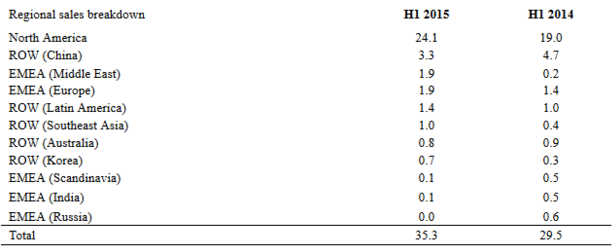

Are these fears justified? Somero’s interim results suggest a mixed picture. Sales in North America rose by 27% during the first half, delivering 68% of the group’s total revenue. The second biggest single contributor was China, where sales fell by 30% to account for 9% of group revenue. Sales were up in some other regions, but outside the US the picture seems very mixed, with limited growth:

However, despite Somero’s more uncertain outlook, Stockopedia’s rankings continue to rate this stock highly, with a StockRank of 97. The question is whether this year’s falls are a buying opportunity, or a warning to take profits while the going remains good.

Value opportunity?

Somero’s ValueRank has been rising as its share price has fallen. The fundamentals have remained strong and the stock now trades on about 9 times trailing earnings and trailing free cash flow. This free cash flow has been used to eliminate debt, accumulate net cash of $9m and fund a well-covered dividend.

Somero’s 3.2% dividend yield is quite respectable for an AIM-listed small-cap. Based on the firm’s cash generation, valuation and income, the stock looks cheap to me. Indeed, when the shares were trading at 143p in September, small cap editor Paul Scott described Somero as “apparently overlooked and mispriced”.

However, as Paul commented at the time, one reason for the apparently modest valuation is that P/E ratings and cash flow can be false measures of value for cyclical…