Delivery firm DX (Group) has delivered a remarkable double-digit gain for shareholders over the last month. The shares have recovered from August’s market correction and surged to around 90p, a level not seen since February. The big gains started on 23 September, two days after DX published its full-year results.

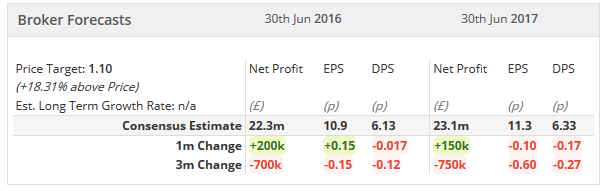

Small-cap editor Paul Scott described these figures as “quite good” and they’ve prompted a modest broker upgrade for the current year:

This combination of factors has made DX Group the biggest StockRank riser over the last month. As I write, the firm’s StockRank is 98 -- a whopping 47 points higher than it was 30 days ago.

There’s only one potential problem. Even after their recent gains, DX shares are valued on just 8.5 times rolling forecast earnings and boast a forecast dividend yield of 6.7%. As Paul explained: “There's only one reason stocks are that cheap - because the market doesn't believe profits are sustainable.”

Is this an opportunity?

DX (Group) offers a mixture of parcel, mail and logistics services, but isn’t simply a direct competitor to mainstream couriers such as Yodel or Parcelforce. Instead, DX offers a range of more specialist delivery services. These include delivering irregular items that are unsuitable for automated handling, 2-man home deliveries, and secure parcel and packet services.

DX (Group) offers a mixture of parcel, mail and logistics services, but isn’t simply a direct competitor to mainstream couriers such as Yodel or Parcelforce. Instead, DX offers a range of more specialist delivery services. These include delivering irregular items that are unsuitable for automated handling, 2-man home deliveries, and secure parcel and packet services.

Among the firm’s more interesting customers are the passport office, for whom DX delivers all passports, and a number of banks and credit card companies.

DX also has a legacy business, DX Exchange, whose customers are mainly legal and financial firms which need secure overnight document delivery. This business is being steadily eroded by email, as you’d expect, but remains important to DX.

Focusing on specialist areas of service makes good sense to me, as these presumably attract a slight price premium. Competing with firms such as Yodel and Hermes in a race to the bottom to offer the cheapest home delivery service makes no sense.

Yet as Paul highlighted in his review of last year’s results, DX’s 8.5% operating margin is exceptionally high for a business of this type. How sustainable are these profits? Are slim margins on parcel work being subsidised by fatter margins at the declining DX Exchange business?

DX (Group) doesn’t break down its profits in its results, so investors are left guessing at the answers…