Value and momentum are usually seen as opposite investing disciplines. In theory, a screen focusing on strong value and momentum should highlight cheap stocks with the potential for big gains.I’ve selected shower and bathroom fitting supplier Norcros in order to try and test this hypothesis.

This company has as Value-Momentum Rank (VM Rank) of 98. This suggests that it combines the characteristics of a value buy with those of an upwardly-mobile momentum stock.This combination of value and momentum is also the classic profile of a turnaround that’s starting to come good.

Stockopedia’s computers like Norcros, giving it a StockRank of 96. Norcros is also a Paul Scott favourite and has cropped up on my own value screens more than once.

Late to the party?

Housing stocks and related businesses such as Epwin have put in strong performances over the last few years. It’s not immediately obvious why Norcros has lagged behind.

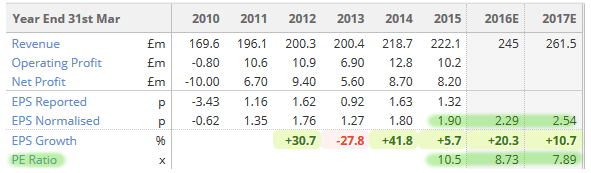

2015 wasn’t a great year, but forecasts for 2016/17 are strong and the shares look cheap.

One possibility might be that demand for the firm’s products lags house sales, as people tend to do up homes after they’ve moved. That doesn’t explain the apparent lack of demand growth from housebuilders, though.

Another possibility could simply be that Norcros doesn’t have the right products. The firm reported sluggish UK trading in its Q1 update and UK sales for the year to 31 March 2015 were flat on the previous year.

I specify UK sales because Norcros also has a South African business, which accounts for around a third of sales and about 20% of operating profit. Norcros appears to be doing better in South Africa. Last year saw sales rise by 3% and underlying operating profit rise by a whopping 68%.

However, the bottom line is that Norcros currently expects to meet market expectations for the full year. These currently suggest that earnings per share could rise by 20% to 2.3p, putting Norcros on a forecast P/E for the current year of just 8.8.

Looking further ahead, the firm’s target is to double revenue to £420m by 2018, using acquisitions to drive growth. Even a partial success here could deliver a big re-rating of the firm’s shares, in my…

.JPG)