Shares in van rental firm Northgate lost a third of their value in 2015, as earnings growth came staggering to a halt. The firm didn’t issue a profit warning, but the cyclical and restructuring momentum which caused profits to double between 2011 and 2015 was clearly fading away.

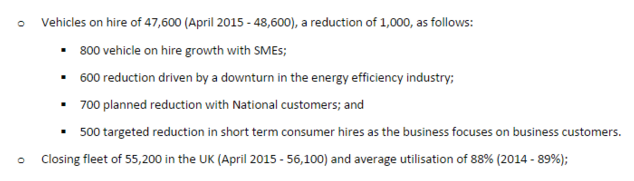

The firm’s interim results, issued in December, confirmed this outlook. Pre-tax profits were down slightly, despite a 3% rise in revenue. The results also revealed that Northgate’s UK fleet contracted slightly during the period, mostly as a result of changes intended to maximise profitability:

We can see that an increase of 800 vehicles on hire to SME customers was largely offset by a slump in the solar panel installation sector. This was triggered by the government’s drastic cuts to feed-in tariffs.

SME customers are the firm’s most profitable, and Northgate is targeting further growth in this area. The firm is pulling back from large corporate (National) customers and consumer customers, both of which are less profitable.

Although most of us think of vehicle hire as a short-term option, this isn’t the case in the commercial sector. A high proportion of Northgate’s business customers use the group’s long-term flexible hire product as an alternative to owning or leasing vans.

This approach has become increasingly popular since the financial crisis and has obvious appeal. Financially, using hired vans keeps the fleet off the balance sheet and avoids the need for financing. Operationally, unpredictable running costs are exchanged for a fixed monthly fee and vehicles can be added or removed from the fleet as needed, with no commitment.

Northgate also operates a very similar business in Spain, where its fleet size is around two-thirds that of the UK. This makes the potential for economic recovery in Spain very material to the outlook for Northgate.

Recovery, value or momentum?

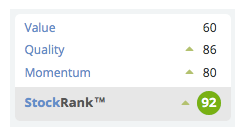

One thing I’ve found interesting is how Northgate’s changing fortunes have been reflected in its StockRanks. Back in July 2015, when Stockopedia analyst Alex Naamani took a look at Northgate, the group’s StockRank profile was that of a high flying Quality-Momentum play:

(July 2015)

Such shares tended to do well last year, but Northgate didn’t. The combination of solid trading but poor share price performance has changed the picture. Northgate is now positioned as a contrarian Value-Quality play, with a QV rank of 98 and rising momentum: