Before I get to this week’s new stock, I’d like to take a brief look at Monday’s trading update from SIF portfolio member Somero Enterprises.

In short, the update confirmed that the firm’s core US market remains strong, with mixed trading elsewhere. Results are expected to be “comfortably in-line with market expectations” for the full year. My reading of this is that earnings could even come in slightly ahead of forecasts, a view small cap editor Paul Scott shares.

SIF portfolio update

One of the apparent shortfalls of my screen is that it isn’t throwing up many defensive stocks. This is making diversification more difficult than I expected. It’s also causing me to wonder whether I’m filtering out desirable stocks.

I’m planning to look at these questions in more depth in next week’s column. What kind of defensive stocks am I missing out on? Is there a good reason to avoid them at the moment?

That’s for next week. The stock I’m going to add to the SIF portfolio this week is FTSE 100 defence giant BAE Systems. This is, I believe, a relatively defensive addition to the portfolio, despite officially being classed as a cyclical stock.

Although BAE’s StockRank of 74 is lower than the majority of the other stocks which qualify for the screen, I do believe it will add some useful diversity to the portfolio. As with GlaxoSmithKline, I’m buying BAE in the expectation of steady long-term returns.

Surprising diversity

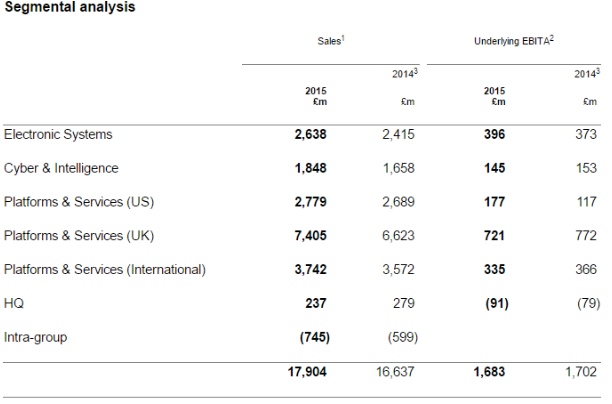

It’s tempting to say that BAE needs no introduction, but in fact I suspect many investors underestimate the diversity of the group’s businesses. Although BAE is best known for aircraft and shipbuilding, around one third of profit comes from its Electronics and Cyber Security divisions:

Source: BAE Systems 2015 results

Source: BAE Systems 2015 results

There seems little doubt that state use of cyber warfare will be a growing issue over the coming decades. I suspect it is already a more widespread problem than we realise. So I’m happy to see that the UK’s biggest defence firm is already a significant player in this market.

Is BAE cheap enough?

BAE’s strongest suits at the moment are quality and momentum. The stock’s ValueRank of 51 is decidedly middling. There seem to…