If you’re interested in developing a more systematic investment style, Stockopedia’s Guru Screens are a great resource. Each screen uses a set of investment rules that have been designed to replicate the approach of well-known and successful professional investors.

These can be a great starting point for developing your own rules and for understanding the common themes that define successful investment styles.

As I write, the top-performing screen based on annualised performance is the Bill Miller Contrarian Value Screen. This has delivered an annualised return of 32.6% since its inception on Stockopedia. US fund manager Bill Miller beat the S&P 500 for 15 consecutive years, from 1991 until 2005. His style focused on finding attractively-valued shares, with good free cash flow and earnings growth.

Interestingly, just six shares qualify for the Miller screen today. This suggests to me that despite recent market falls, many companies face an uncertain outlook and are not necessarily cheap.

One company that does qualify for the Miller screen is smoke and carbon monoxide alarm specialist Sprue Aegis. This small cap moved from the ISDX index to AIM in 2014, and has performed very strongly since then.

I considered looking at Sprue Aegis at the start of the year, but thought the shares looked fully priced. The firm then issued a solid trading update on January 20, which Paul Scott commented on here. However, since then, Sprue shares have have fallen by more than 20%. Has the market sell off thrown up a bargain?

Stockopedia’s Guru Screens certainly suggest this view. Sprue Aegis is one of only 12 UK stocks out of 2,726 covered by Stockopedia to qualify for five or more Guru Screens. Sprue Aegis also has a StockRank of 94.

Why does it score so highly?

Improving value

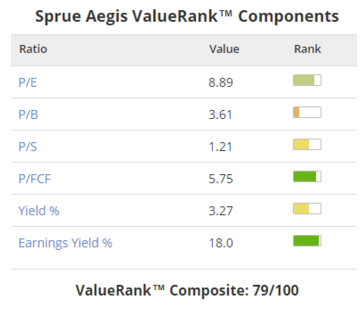

As we’ve seen, Sprue Aegis shares are more than 20% cheaper than they were a month ago. That’s a good starting point. It’s also is one of the reasons this stock’s ValueRank has risen by 14 places to 79 over the last 30 days.

Looking under the bonnet of the ValueRank, it’s clear that Sprue is not an asset play. This stock’s value credentials lie in its valuation, relative to free cash flow and operating profits:

The two standout numbers here are a trailing price/free cash flow multiple of just 5.75 and an earnings…