Entertainment One is best known as the controlling shareholder of the Peppa Pig brand.

The firm recently announced plans to produce no fewer than 117 new episodes of this very popular programme. This will take the total number of Peppa Pig episodes up to 381.

However, the new episodes won’t start airing until Spring 2019. And having read through the firm’s recent results, I’m concerned about the outlook for shareholders over the next couple of years.

As there are no new qualifying stocks for the Stock in Focus portfolio this week, I’m going to take a closer look at Entertainment One instead and explain why I’m not attracted at current levels.

A falling star?

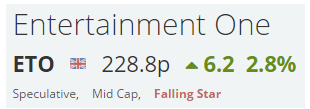

I’ve been impressed with Stockopedia’s new StockRank Style and RiskRating classification systems. Very often, these new classifications seem to me to be a very accurate representation of a stock’s likely character.

Entertainment One doesn’t fair well under this new system. It’s ranked as Speculative and as a Falling Star:

Falling Star isn’t necessarily a terminal condition. But it does indicate that statistically, this stock is likely to underperform:

However, I’m not basing my negative view on this rating alone. I think that Stockopedia’s ratios flag up several other reasons why now might not be the right time to invest. I also believe that Entertainment One’s latest accounts highlight a few areas of potential concern. Let’s address these factors one at a time.

The algorithm isn’t keen

If you’d like to review a stock in more detail without ploughing through the actual accounts, then breaking down the company’s StockRank is often a good place to start. As a reminder, you can find this information by going to the sector page for the stock and then clicking on each of the ranks to see the scoring breakdown.

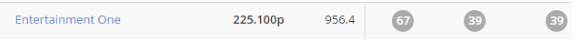

Entertainment One doesn’t score especially well on any of the three main ranks (Quality, Value, Momentum):

The stock’s QualityRank of 67 is the strongest of the three, but even this isn’t as impressive as it first seems. All of the factors are average or poor, except the Piotroski F-Score, which is a respectable 7/9:

ETO’s library was independently valued at $1.5bn (c. £1.18bn) at 31 March 2016. This valuation hasn’t yet been…