I’ve tried hard to steer away from housing stocks over the last six months, I really have!I believe it’s probably too late in the housing cycle to make worthwhile profits from these stocks.But the listed housing sector has continued to perform well. In most cases, profits, free cash flow and shareholder returns are all rising.

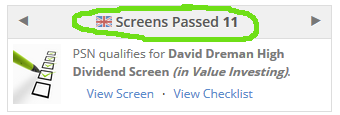

The housing sector also provides Stockopedia with some of its highest-ranked stocks. Top of them all is Persimmon, which boasts a StockRank of 99 and qualifies for no fewer than eleven long Guru Screens. That’s more than any other UK stock:

Persimmon’s net profit rose by 40% last year. The group’s shares are up by 5% so far in 2016. That’s impressive given that shares in peers such as Berkeley Group, Barratt Developments and Bellway have all fallen by 5-10%.

I think it’s worth taking a closer look at Persimmon. Why is this firm performing and ranking so strongly?

Political risk

The housing market is a British obsession. No other country in Europe has such high levels of home ownership. As a result, the government has introduced policies which have had a distorting effect on the housing market.

Help to Buy is a good example. Last year, 42% of Persimmon’s 14,572 sales were to buyers who had taken advantage of this loan guarantee scheme. That’s staggering, in my view. It’s probably fair to say that without Help to Buy, house prices and transaction numbers would both be lower.

Help to Buy is a good example. Last year, 42% of Persimmon’s 14,572 sales were to buyers who had taken advantage of this loan guarantee scheme. That’s staggering, in my view. It’s probably fair to say that without Help to Buy, house prices and transaction numbers would both be lower.

This introduces a level of political risk to owning Persimmon and other housebuilders. Help to Buy may one day be withdrawn. I don’t think this is likely to happen very soon, however. The consequences could be quite dramatic. I’m not sure any government will be in a rush to find out how the market would react.

Is Persimmon still cheap?

After rising by 371% in five years, you wouldn’t expect Persimmon shares to be cheap.

At first glance, they’re not. A trailing P/E rating of 12.6 may seem modest, but valuing cyclical stocks against earnings can be misleading. Persimmon’s earnings per share rose by 35% in 2015 and by 46% in 2013. Valued on 2013 earnings per share, Persimmon stock has a P/E of 25!

I prefer to take a more…