I recently re-read Jim Slater’s growth investing classic, The Zulu Principle. This inspired me to take a fresh look at some of the UK stocks which the great man might have purchased.

This task was made much easier by Stockopedia’s Jim Slater ZULU Principle Screen, which saved me the effort of creating a suitable screen. The Zulu Principle screen has delivered annualised gains of 23% since its inception, making it the fifth best-performing Guru Screen on Stockopedia.

I was surprised to see that only eleven stocks currently qualify for the Zulu screen. This suggests that for growth investors at least, the recent market sell-off may not have been a great buying opportunity. Many stocks seem to remain fully valued or have an uncertain outlook for earnings.

Of the eleven stocks which qualify for the screen, only six have StockRanks of more than 80. One of these is recruitment firm SThree. This is a FTSE Small Cap-listed group with a market cap of £394m, and a StockRank of 93.

SThree owns a fairly diverse mix of recruitment businesses, which operate in a mix of geographies and sectors. The group’s main brands are:

- Computer Futures (IT/Europe);

- Progressive Recruitment (engineering/energy/W. Europe, Asia, M. East);

- Huxley (finance/W. Europe, Asia, M. East)

- Real Staffing Group (Healthcare/Life Sciences/W. Europe/Asia/USA)

I’ve listed each of these to provide an idea of SThree’s diversity. This is important because at this potentially late stage in the economic cycle, investing in such companies carries the risk of being too late to the party.

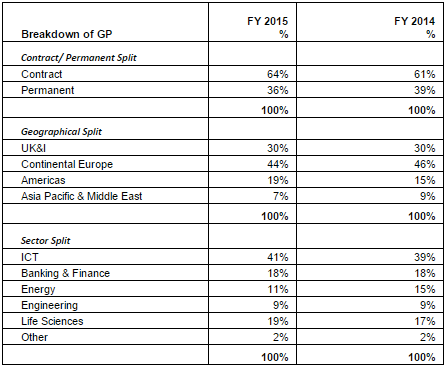

In my view, SThree’s diversity should provide some protection from this risk. Here’s a screen grab from January’s final results, showing how SThree’s gross profit breaks down across different sectors and geographies:

These figures suggest that IT and Life Sciences may be able to pick up some of the slack from the energy sector.

There’s more…

SThree has two other characteristics which suggest to me that the interests of the group’s management may be well aligned with those of shareholders.

Chief executive Gary Elden owns 2.8m shares. This gives him a 2.2% stake that’s currently worth about £8.5m. Mr Elden’s dividend income in 2015 was roughly equal to his basic salary, which rose by a comparatively modest 4.7% last year. This suggests to me that he’s likely to be keen on maintaining an affordable and progressive dividend.

Mr Elden and two of the three other executive directors have all…

.JPG)