A recent article in the Financial Times noted that hedge funds have started to short UK asset managers. Companies with high exposure to emerging markets, namely Ashmore and Aberdeen Asset Management, are on the hit list, as funds including Odey Asset Management and Marshall Wace have taken short positions in recent months. Last year hedge funds shorted iron ore producers as a way of betting of weaker demand in emerging markets. Ashmore and Aberdeen appear to be the latest targets, but both companies have high QualityRanks. Would it be wise to short these companies?

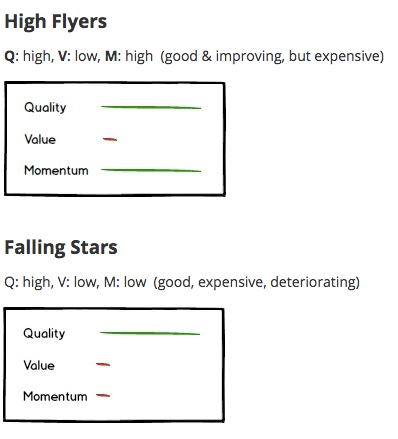

Falling Stars

In his recent article, A Taxonomy of Stock Market Winners, Ed distinguished between companies that have Winning Profiles and Losing Profiles. One category of winning stocks was the High Flying stock. These companies tend to be expensive, but are very high quality and have strong momentum. Companies that qualify for Stockopedia's William O'Neil screen tend to be High Flying stocks, with fast earnings growth and strong share price momentum.

However when the momentum finally turns, High Flyers can easily turn into Falling Stars (ie. expensive, high quality companies, with poor momentum). Ed warns that when 'brokers start aggressively cutting their estimates on high quality, premium shares look out below. This is the classic profile of stocks like ASOS when they start to drop.'

After years of glory, are Ashmore and Aberdeen Asset Management becoming Falling Stars? Let's take a closer look.

Quality

Ashmore and Aberdeen Asset Management both have high QualityRanks (82 and 75 respectively). This means that the companies have QualityRanks in the highest quarter of the UK stock market. Operating margins have been steady. Ashmore's margins have consistently been around 65% since 2009, while margins at Aberdeen have stayed around 30% since 2011.

The firms also enjoyed strong sales growth, which took place as assets under management increased, and investment performances remained strong, particularly in emerging market equities. Indeed, Aberdeen Asset Management managed to grow revenues each year between 2008 ( £421m) and 2014 (£1,118m). Similarly, Ashmore grew sales from £245.7m to £355.6 between 2009 and 2014. Aberdeen and Ashmore were well placed…