The great Warren Buffett once said he likes to buy ‘quality merchandise when it is marked down.’ He has previously proved adept at picking up companies with a strong franchise that are undervalued by the market because of temporary problems. The toymaker, Games Workshop, has been through a restructuring programme which has placed downward pressure on the share price over the last few years. Nevertheless, the company has a strong brand, commands impressive pricing power, and the StockRank has recently jumped from 79 to 95. Is this an opportunity for investors to buy a good company at a cheap price?

Quality merchandise

Pricing competition is common across the toy market. Toymakers like Hornby have to make do with operating margins of just 0.6% and a ROCE of just 1%. Games Workshop on the other hand has high operating margins (14%) and a good Return on Capital Employed (31%). How do they do it? The company has built a cult around the design and manufacture of miniature figures and games. It is somewhat insulated from pricing competition because the firm is the sole producer of many products like the Warhammer figurines.

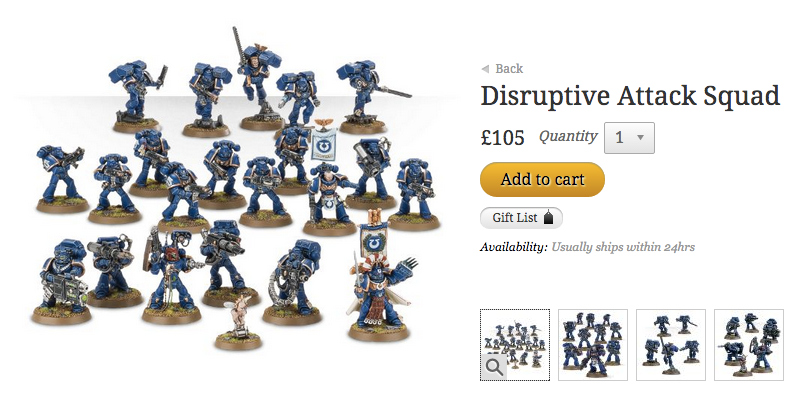

The firm also has a loyal customer base which puts it in a good position to charge high prices. Our own Paul Scott noted that the ‘slightly odd customers that these shops attract are probably very loyal, as they are locked into that nerdy lifestyle, and probably won't be getting married anytime soon.’ These customers tend to value “quality above price”. For example, a set of ‘Disruptive Attack Squad’ figurines costs £105 (image below). Most figurines need to be glued together and painted with paintsets that can cost as much as £99. The diehard Warhammer fan will allegedly buy an entire set of new figures if they make just one mistake on one figurine.

Strong profit margins could also be supported by the firm’s lean business model. The company has 418 stores across 20 countries. 324 of these are one man stores, located on small sites. This limits overhead costs and would make it cheaper to open new stores as the company expands. Finally, the company has a strong balance sheet with no gross gearing and a current ratio of 2, suggesting that the company could be in a good…