In his fascinating book, The Singularity, Ray Kurzweil predicts that by 2045, artificial intelligence will become so advanced that humans will have no choice but to augment their minds and bodies with genetic alterations, nanotechnology, and artificial intelligence. This might sound like science-fiction, but many people agree with Kurzweil's thesis. In China, a fully robot-staffed restaurant has already been running for several years. According to research by Gartner, one in three jobs will be replaced by some kind of software, robot or smart machine over the next decade.

Should we be scared? Apparently, it is possible to make money from this technological process. The fund manager, Jim Mellon, has written a book, Fast Forward, where he analyses some of the companies that are already producing technologies which automate manufacturing processes. Are these companies good investments? Let's find out by using the StockRanks to analyse some of the stocks he mentions.

Hansen Medical (HNSN)

Hansen Medical - a US-quoted manufacturer of medical robotics - saw its share price spike back in January. The firm reported that the first procedure using its Magellan Robotic System had been completed in Australia. The Magellan System can be used by physicians to navigate blood vessels during endovascular surgeries. Back in January, the Australian doctors used the Magellan System to complete a chemotherapeutic procedure to treat liver tumour. One advantage of this system is that it enables physicians to perform medical procedures while seated at a remote physician console, away from radiation.

Hansen Medical - a US-quoted manufacturer of medical robotics - saw its share price spike back in January. The firm reported that the first procedure using its Magellan Robotic System had been completed in Australia. The Magellan System can be used by physicians to navigate blood vessels during endovascular surgeries. Back in January, the Australian doctors used the Magellan System to complete a chemotherapeutic procedure to treat liver tumour. One advantage of this system is that it enables physicians to perform medical procedures while seated at a remote physician console, away from radiation.

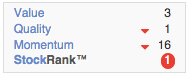

Nevertheless, the StockRanks suggest that Hansen Medical could just be a story stock. It produces state-of-the-art medical equipment, but unfortunately fails to generate any money. Earnings per share figures have indeed been negative since 2009. The company has a Piotroski F-Score of just 2 out of 9, partly because its capacity to service debt is decreasing and its pricing power is deteriorating. Furthermore, its Altman Z-Score suggests that the company has a high risk of bankruptcy. Its overall StockRank is 1. The MomentumRank has fallen to 16 out of 100, while the QualityRank has fallen to 1 out of 100.

Kuka AG (KU2)

Kuka AG is a Germany-based company focused on…

Kuka AG is a Germany-based company focused on…