Greece has been making headlines recently. The left-wing Syriza party secured their election victory on the back of promises to end austerity measures, which have hitherto been a precondition for debt relief. The prospect of another Eurozone crisis is on everyone's mind again. Athens' main stock index was down 3.2% the day after Syriza's victory. The full impact of Syriza's policy may well take some time to play out, but at Stockopedia we couldn't help wondering whether there might be any opportunity to pick up good quality Greek shares at knock-down prices.

Is Greece undervalued?

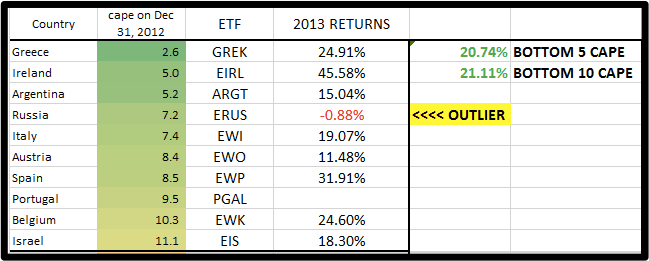

At the start of 2014, Meb Faber (CEO: Cambria Investment Management) showed that Greek stocks were, on average, the cheapest in the world (see here). Faber uses the CAPE to analyse stocks. The CAPE, or cyclically adjusted P/E ratio, is defined as price divided by the average of ten years of earnings. It therefore seeks to smooth out the economic cycle and allow for better comparisons over time.Faber's research suggests that companies, and indeed countries, with lower CAPEs tend to outperform countries with higher CAPEs. For example, in 2013 cheap countries like Greece and Ireland returned 24% and 45% respectively (see below);

(Source: CAPE Returns for 2013, Meb Faber Research)

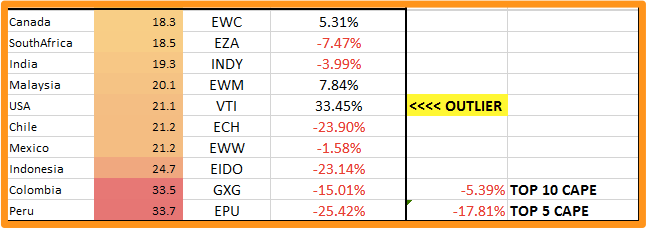

On the other hand, expensive countries like Colombia and Peru dropped by 15% and 25%...

(Source: CAPE Returns for 2013, Meb Faber Research)

Is Greece still cheap? We can use the StockRanks to see the wood through the trees and analyse individual stocks.

Aegean Airlines SA (AEGN)

Aegean Airlines (Greece's largest airline) has the characteristics of a recovery stock. A useful metric to identify cheap companies on the mend is the Piotroski F-Score, which looks for companies that are profit-making, have improving margins, don't employ any accounting tricks and have strengthening balance sheets. Aegean Airlines has a good F-Score - 8 out of 9.

Aegean Airlines (Greece's largest airline) has the characteristics of a recovery stock. A useful metric to identify cheap companies on the mend is the Piotroski F-Score, which looks for companies that are profit-making, have improving margins, don't employ any accounting tricks and have strengthening balance sheets. Aegean Airlines has a good F-Score - 8 out of 9.

This progress has been supported by network expansion, as well as the acquisition of Olympic Air in 2013. At one point it looked like the acquisition would be blocked by the European Commission, on the basis that the merger would have created a "quasi-monopoly" in…