STOCKS VERSUS BONDS - THE NEXT TEN YEARS?

Stocks Versus Bonds

Equity investors see any prospective stock dividend yield as being the definitely the better alternative than the current negative or near zero bond yields available. Equity investors are choosing en-mass to ignore the fact that share prices are already on high p/e ratios with reduced earnings expectations and promise to deliver smaller future dividend yields. Equity investors it seems will continue to revisit the stock market to invest and take part in the stock market indices edging higher.

Equity investors may discover in time that those same dividend yields come at a potential capital loss by the same share prices falling over time. One must ask the question. Why do bond investors continue to keep buying bonds?

Bond investors are normally consider to be a bit smarter than equity investors. Maybe this point of view comes from the fact, that bond investors are just right more often than equity investors! Bond market investors don't shout from the rooftops justifying their negative yield positions versus equities, but it is the equity investors who shout regularly on how foolish are the bond investors.

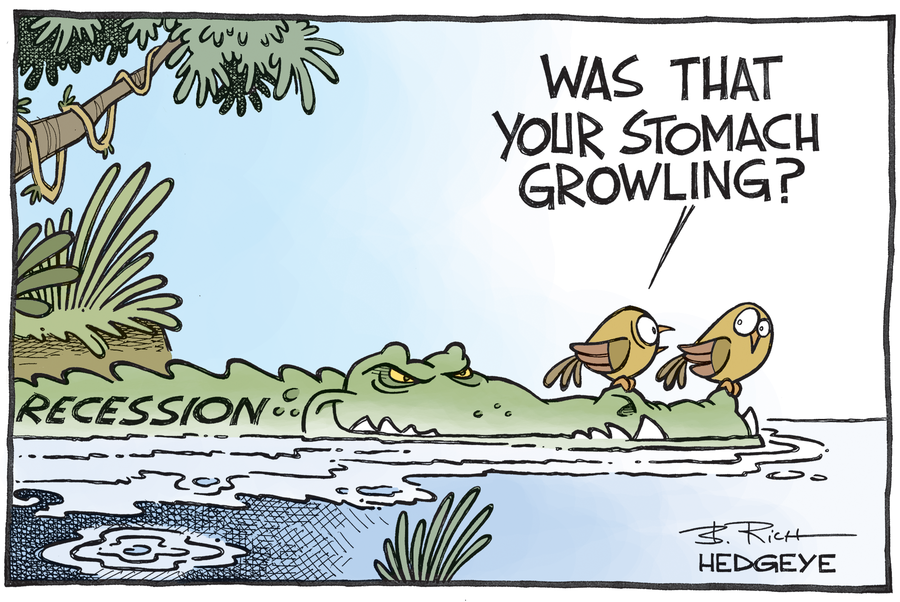

The investment case for bonds is a pessimistic view of the world to say the least.Do bond investors perhaps know something that equity investors have not taken onboard? Why are bond investors increasingly willing to ignore 3 or 4% dividend yields per year from stocks in favour of virtual zero interest bonds.

Bond investors, must reckon that stock markets indices will be down more than 50% in ten years time. Stock holders are just simply being paid dividends of out of their own captal. In 10 years time having received circa 30% in taxable dividends, the equity holders will find a potential 50% loss in their capital through a 50% drop in stock market indices.

In this scenario, bond investors must be expecting company earnings to fall for most of the next 10 years. Reasons that this might happen could be the over investment in so manny industries, the lack of consumer confidence, higher taxes, coupled with pressure to balance budgets and the general backdrop of a deflationary environment.

A Japanese Lesson

Maybe our investment cue should come from Japan. Let's say that you invested monthly in the stock market from 1980 and were planning to retire in 2020. Taking the equity approach over such a long…