Story stocks are defined as companies whose products exploit new or breakthrough technologies or processes, which are incurring losses in most cases higher than their revenues (if any), and burning investors capital at an alarming rate. The promise of course is vast riches down the road with a share price that will multi-bag several times.

This is not just confined to the Silicon Valley start-ups but examples can be found in the AIM market too.

The question is how should private investors approach such stocks.

If your risk appetite is very low, then the answer is very simple: just stay away.

So assuming that you are willing to take a moderate amount of risk, how best can you invest profitably?

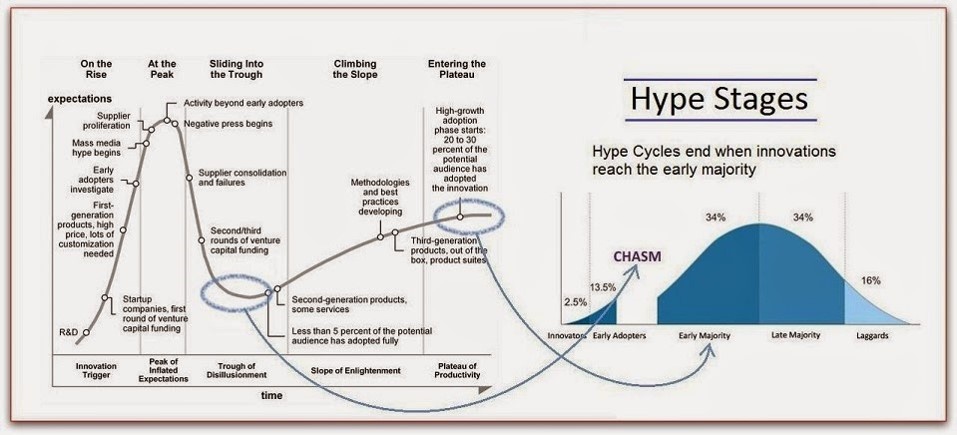

Before you start to look at any potential company that you might fancy, it is crucial that you fully understand the Hype Stages (courtesy of Gartner Inc). See the diagram below.

Every new technology or trend goes through these 5 fundamental stages: "On the Rise", "At the Peak", "Sliding into the Trough", "Climbing the Slope" and "Entering the Plateau".

Each stage has recognisable milestones. For example you can tell when the hype is reaching its peak when mass media starts to take an interest and bulletin board chatter multiplies.

The vast majority of story stocks never complete the full cycle. They bite the dust a lot earlier. Out of a hundred of would-be hopefuls, my guess is that around 80% never complete Stage 1 "On the Rise", and less than 1% make it to the end to become the new Amazon, Google, etc.

So how do we, foot soldier investors, make a profit in this environment? I would like to offer two strategies.

Strategy 1. Pick a story stock which is an early stage in Stage 1 "On the Rise" with a view to selling out before the mass media and the rest of the investment community piles in. You could multi-bag several times during this period. Or you could lose your shirt much faster. But without putting numbers to this, the risk:reward ratio is in my view attractive enough, as long as you are prepared to accept a complete wipe-out.

Strategy 2. This is possibly the more intelligent strategy. Pick stocks which are at an early Stage 4 "Climbing the Slope". Better still, go for the sector/ market leaders in this space. The downside is limited as by this stage the technology…