In Part 19, we introduced the idea of Heikin Ashi. In part 20, we go off on a more extreme tangent! In terms of Technical Analysis applications, Renko Charts, at first glance, could appear to be as ‘way out’ as it gets – the work of some Technical Analysis boffin with too much time on their hands! In fact, Renko charts aren’t some new tool created by the technological revolution, but have their roots firmly embedded in eighteenth century Japan. They were originally applied to trade Rice and formed the building blocks for a robust trading strategy.

What are Renko charts?

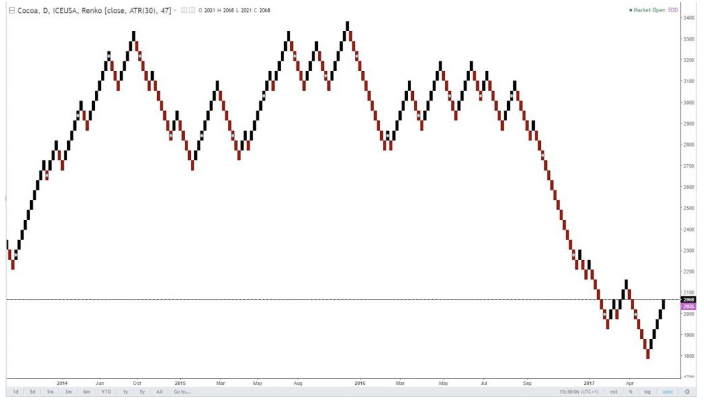

These charts were named from the Japanese word for bricks, “Renga”. This type of chart completely ignores time and focuses only on price changes that meet a minimum requirement. Renko charts use price “bricks” that represent a fixed price move. They move up or down in 45 degree lines with one brick per vertical column. Because of this unique approach to charting, it creates some great analytical applications for trading.

Example: New York Cocoa (Charts: TradingView)

Setting the brick size and chart

Brick sizes are predetermined by the analyst/trader and are a very discretionary process. Familiarity with the instrument you are looking at can help. The bricks are given a fixed value that, like Point and Figure charts, will filter out smaller price movements, in the process leaving the user a clearer picture of the asset’s trend. Because Renko ignores time, bricks will only change once the preset criteria is met. For example, if the brick value is set to 100 points, then a move of 100 points is needed to draw another brick. Anything less would be ignored and the chart would remain the same.

The chart: In practice, this is normally set up off the close or a range e.g. high / low. The Close gives one data point and less volatility to the chart, compared to a ‘range of data’ approach which increases the fluctuations in the bricks and therefore results in more bricks. One way of countering this volatility could be to take the High/Low and divide by 2. Which one to use? It’s down to your own personal preference and trading strategy/approach.

Brick size: This can be a fixed number e.g 20, 50, 100 – whatever you think is appropriate, but…