With interest rates on deposit accounts extremely low and bond prices destined to fall large cap companies are missing a great opportunity to recruit a new cohort of income seeking shareholders. Many investors should be looking to large cap companies to provide them with regular income. However, the typical way in which UK companies pay-out their dividends is not that regular, straightforward or investor friendly.

UK plc's typically arcane method of rewarding its shareholders

Vodafone is a case in point; it pays its dividends twice a year. It first pays an 'interim' dividend of roughly a third of what can be expected to be received over the year and then a final dividend of two thirds. However, it’s not until the larger final dividend is declared that it's clear what the total pay-out for the year will be. It may be increased or not, it's very much up to the Board of Directors to decide whether to increase the dividend and if so by how much. With the major portion of the total pay-out made in the second payment there is a large degree of uncertainty.

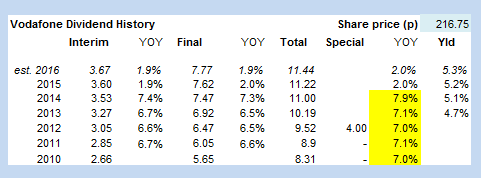

Nevertheless, in most cases a company will look to increase the dividends that they pay on an annual basis – which is a key potential advantage of dividends over other fixed-income investments. Vodafone, for example, has a good track record of increasing dividends:

Between 2010 and 2014 Vodafone increased its dividend by 7% or more (see table) but this is obscured in what appears as a fairly irregular stream of fluctuating dividend payments.

Quarterly Dividends are the norm in the US

Quarterly dividends are what US stockholders expect to receive. For a UK company quoted in the US with US ADR holders - paying its dividends semi-annually is very confusing for US stockholders – it’s just not what they expect. Many US investment websites are not set-up to handle the quaint UK semi-annual dividend payments regime and without an explanation the yield metrics calculated do not make sense. One wonders why a company would wish to have a US quote and then confuse their potential investors?

It's time for large cap companies to move to quarterly dividend payments

Changing to paying dividends quarterly would be far more investor friendly, particularly for those relatively unsophisticated income seekers that have acquired a large lump sum from their pension. The benefits would be:

- Greater transparency: A smoothed…