I launched The Great Irish Share Valuation Project in Jan-2012 with all due confidence & bravado. [The ultimate irony in business & government is that people quickly learn (insane) confidence is the best way to get ahead, while ignoring it can also lead to the most spectacular of downfalls!]. It was actually a rather daunting proposition at the time…

Not necessarily because of the number of stocks involved – Ireland’s one of the few developed markets where it’s entirely possible to roll up your sleeves & get to know each stock pretty well. [I count 70 stocks in my latest file]. That may or may not float your boat, but I think it’s another good reason to put the Irish market on your to-do list this year. Picking out 2 or 3 safe & cheap stocks is a real luxury – it’s infinitely more challenging to tag every single stock with a bull or bear call (let alone a price target!), and to then up the stakes with an aggressive weighting on each stock holding.

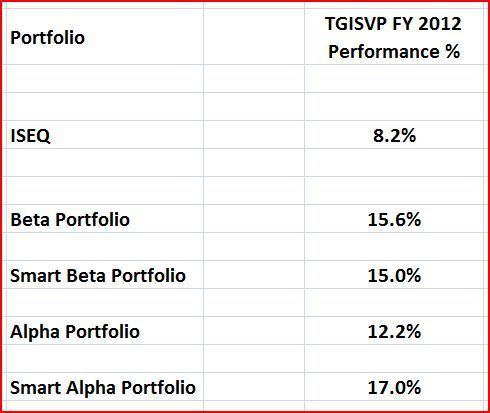

Fortunately, Q3-to date, the TGISVP Portfolios*** consistently out-performed the ISEQ index! So, what have I got to report for FY 2012..?! Here we go:

For reference, here’s my complete TGISVP file:

TGISVP FY 2012 Performance (xlsx file)

TGISVP FY 2012 Performance (xls file)

I’ll add my usual disclaimer: ISEQ YTD performance is measured from Feb-6th. I previously noted: ‘I think the fairest, and most comparable, benchmark to use is the ISEQ’s performance since Feb-6th. The valuation stage of the Project was stretched out over Jan-March, but on that date I reached the half-way point, so this is a good average starting point for a benchmark comparison. It’s not perfect, but I think it’s the simplest and most obvious solution.‘

[NB: Actual ISEQ FY 2012 performance of 17.1% was, of course, significantly higher (due to strong gains in the first five weeks of 2012). But I think it's quite reasonable to presume we'd have seen similar levels of out-performance if the TGISVP portfolios were assembled/published simultaneously on Dec 31st, 2011, thereby benefiting from cheaper Irish share prices as a starting point.]

I’m delighted to see this level of out-performance across the board!

On average, it amounted to an incremental 6.7% return vs. the index. Which turns…