Continued from here.

Economy

Germany’s by far the largest & strongest (major) economy in Europe, with an average real GDP growth rate in excess of +3.3% in 2010 & 2011. Growth remains positive in 2012, while 2013 GDP growth’s forecast to be +1.7%. Far better than most EU growth rates in the same period…

It’s one of the few countries with a primary budget surplus. Actually bested by Italy, what a surprise! Germany’s Debt/GDP ratio at 81.6% isn’t much better (also surprising) than the EU average of 88.2%. But the majority of citizens (& investors) remain supremely confident in Germany’s ability to manage its own finances – and rightly so, I believe. [An important point to make: Now, really, an 88% Debt/GDP ratio? What crisis..!? I think not. I'd venture we can trace the current market hysteria squarely back to the bumbling & foot-dragging of Europe's politicians. A clear message for US politicians as they merrily race down their own fiscal/debt Highway to Hell. An inability to learn from history's unfortunate, but perhaps forgivable - an inability to learn from today's headlines, however, just makes you a complete f**king idiot,sir!]

Inflation remains pretty Germanic, at a current +1.9%, the best in Europe (bar Greece, still bizarrely putting up a positive inflation rate in the depths of a recession!? What a broken bloody economy!). However, Germans (& investors) are v aware of the fiscal deterioration elsewhere in Europe, and the monetary actions of the ECB to date & to come. Generational memories of the effects (& consequences) of inflation remain strong in Germany, and fear may well prove a major factor in increasing demand for property.

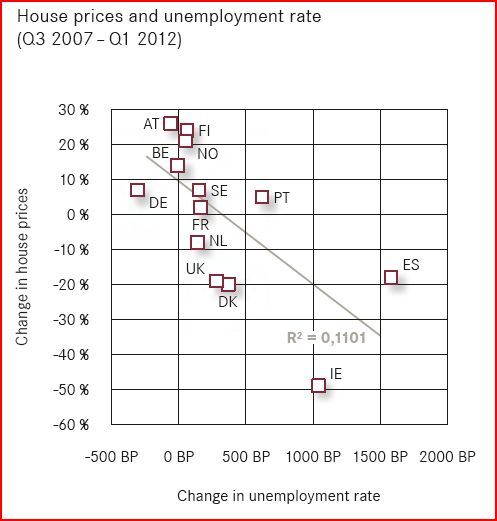

Finally, Germany’s got one of the lowest unemployment rates in Europe, at 5.4%. Interestingly, its closest neighbours (Netherlands & Austria) have similar/lower rates. It’s also one of the few with an improved unemployment rate y-o-y. In my opinion, the relationship of housing prices to a country’s unemployment level’s often under-stated in property reviews. This chart provides a good illustration of that correlation:

All in all, Germany appears to present an attractive macro backdrop for housing prices. But you might argue there are significant risks to Germany’s (& Europe’s) 2013 growth forecast. Perhaps, but there’s nothing new in today’s headlines – one could reasonably argue…