The Greek debt crisis has sucked the wind from the sails of European indices in recent months. Yet among the EU investment strategies tracked by Stockopedia there have still be some strong performances. One of the highlights has been a surge in returns from Quality focused models, including a great run by the Screen of Screens. For investors in European opportunities, the SOS has proven a source of strong ideas.

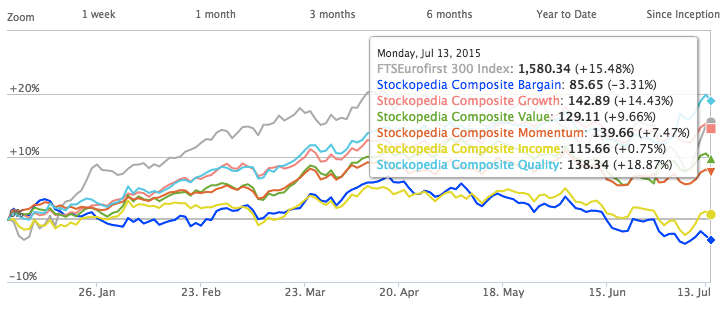

While the relentless negotiations over Greece have unsettled European markets, they have clung on to much of their early gains in 2015. The FTSEuroFirst 300 index of the largest European companies by market cap got off to a cracking start in 2015, and remains up by around 15%. The FTSE Euromid, a benchmark of mid-cap pan-European companies, has done even better, rising by 20%.

Meanwhile, the composite of all of Stockopedia’s Quality-oriented screens has risen by 18.9%. We’ve seen some particularly strong gains in the Warren Buffett inspired strategies and a 24.3% return from the Screen of Screens this year.

What makes the Screen of Screens tick?

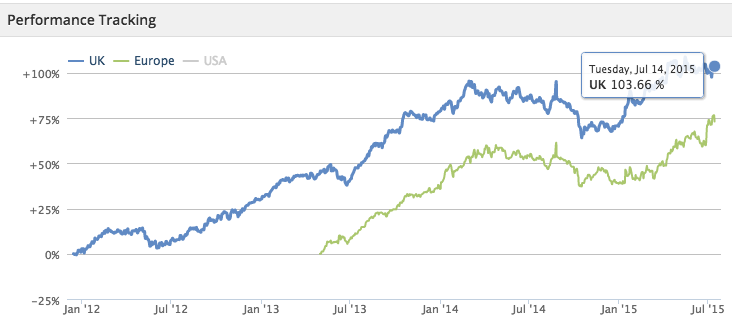

To qualify for the Screen of Screens, a share must pass the rules of at least four other long-only, guru-inspired strategies. Across our European edition (which includes the UK) there are only 114 companies that do that. While the SOS could be seen as a rather blunt proxy for quality, the strategy has performed well since inception.

Like all the other models, it’s rebalanced quarterly and the performance returns don’t account for costs. But even so, the UK screen has returned 103.6% since December 2011, and European version is up 73.1% since May 2013. In both regions the strategy saw declines through 2014.

Perhaps unsurprisingly, when sorting the SOS list for those companies that appear most on other screens, patterns do emerge. Predominantly they have high StockRanks. That reflects a higher likelihood that stocks on multiple strategies often tick the boxes across the Quality, Value and Momentum factors that make-up the StockRanks. In addition, and with a few exceptions, they also come with high dividend yields. But there appears to be very little pattern in the sector exposures - these companies operate in a variety of industries.

| Name | Market Cap £m | Stock Rank™ |

Unlock the rest of this article with a 14 day trialAlready have an account? 0 comments |