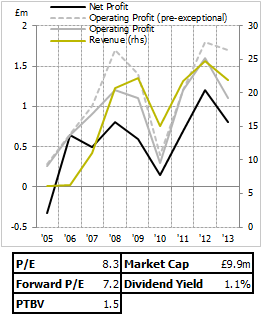

Tricorn, a member of the portfolio for a few weeks now - and rather happily up ~15% in that time, though that statistic isn't worth much given the absurd volatility of shares this small - released their preliminary results for 2013 yesterday. It's probably fair to say the results were slightly better than expected, beating forecasts by a decent amount; make of that what you will. In more absolute terms, revenue declined by 12% while underlying operating profit stayed roughly the same, at £1.7m. I've updated the graph on the right to show the new figures, and also the valuation box beneath.

Tricorn, a member of the portfolio for a few weeks now - and rather happily up ~15% in that time, though that statistic isn't worth much given the absurd volatility of shares this small - released their preliminary results for 2013 yesterday. It's probably fair to say the results were slightly better than expected, beating forecasts by a decent amount; make of that what you will. In more absolute terms, revenue declined by 12% while underlying operating profit stayed roughly the same, at £1.7m. I've updated the graph on the right to show the new figures, and also the valuation box beneath.

In many ways, these results in themselves are sort of less interesting than they might usually be; we look at results to tell us about what has happened with the business over the last year, to try and figure out where things are going and if they are performing as they have done historically. Given the amount of change that's happened at Tricorn, though, this is less the case here. The US acquisition relatively late in the year, as well as the expansion into a Chinese manufacturing facility that was ongoing means that the real crunch time is the next couple of years, not this one. This morning I spoke to Mike Wellburn and Phil Lee, CEO and FD, about the figures and that sort of theme - of a changing business - was something Mike was rather keen to emphasise. He was very much talking about the US and China as being transformational and talking about the effect that will have on the business in the near future.

This is still clearly true, though it's obvious that that strategy doesn't come without risk. I note that this year's revenues don't fully reflect the loss of that significant Rolls-Royce contract in November, and given that revenues are already down 10%, that's more of an obvious headwind for the UK bits of the business as well. The company did well to maintain operating profit given that revenue fall, though, and the directors attributed that to (and noted they were continuing with) the usual 'rightsizing', keeping costs in line etc. I say usual since it's a bit of a universal management cliche, but more often than not it's a failed endeavour, so success here makes a pleasant change.

Given the scale…

.png)