Vertu Motors (LON:VTU) released their half year figures last week, and the market was pretty happy with them - shares were up 10% on the news. This isn't a massive figure in itself, but Vertu's shares have done rather well for the portfolio in the period I've been holding them - they're up about 50% since my June purchase. The car dealership sector is one I'm quite familiar with - before Vertu, I had held Lookers (a larger listed competitor) since the portfolio began. Those shares had booked me roughly a 100% gain in the 2 years I held, and it was off the back of a longer-than-usual sectoral look that I decided to plump for Vertu.

Vertu Motors (LON:VTU) released their half year figures last week, and the market was pretty happy with them - shares were up 10% on the news. This isn't a massive figure in itself, but Vertu's shares have done rather well for the portfolio in the period I've been holding them - they're up about 50% since my June purchase. The car dealership sector is one I'm quite familiar with - before Vertu, I had held Lookers (a larger listed competitor) since the portfolio began. Those shares had booked me roughly a 100% gain in the 2 years I held, and it was off the back of a longer-than-usual sectoral look that I decided to plump for Vertu.

After a 50% price increase, I think another evaluation is wise. You'd either needed to have pencilled in a large mispricing to begin with, or have seen a sizable improvement in the group's prospects, to feel as comfortable now as you did when you bought. Neither of those things are impossible, but I like to err on the side of prudence - and as I take a pretty hands off approach to managing my portfolio, I don't mind taking the chance to refresh my memory every now and then.

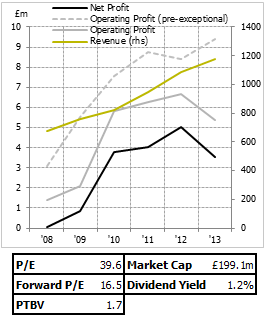

I should say to begin with that if the table to the right makes Vertu look significantly more expensive than usual, that's to be expected. Vertu raised £50m in the year and invested in new dealerships having already spent their existing resources and with a decent amount of inbuilt growth anyway. Last year's earnings figure is irrelevant in the sense of a price to earnings. The PTBV figure, though, isn't irrelevant. That figure gives us the intuition as to the valuation of the group.

The asset story

When I bought into Vertu, I bought in at a PTBV of about 1. That is to say, every pound you paid for the business bought you a pound of tangible assets. The investment thesis then was pretty simple - the management team, by virtue of their strategy, are sitting on a business which looks like it's underperforming. They're buying underperforming dealerships cheaply, and spending the next couple of years turning them around, both by managing the businesses better and as a consequence of being part of a…

.png)