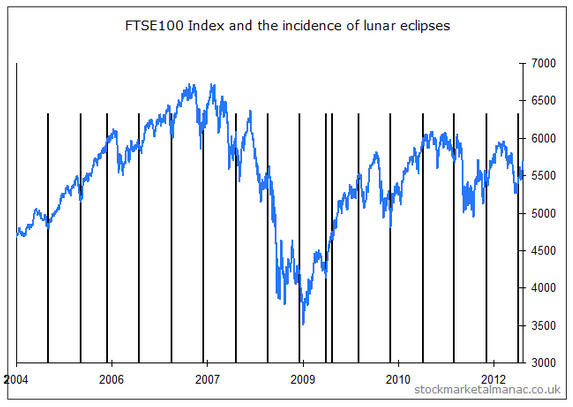

Housebuilders, wealth managers and oil stocks all had varying degrees of good news in this week's Budget, helping to push the FTSE 100 through 7,000 points. But what about Friday's solar eclipse? Could that have had an 'anomalous influence' on the rapid rebound of the FTSE from its sharp fall in early March? According to some research there could be a connection. Alas, reaching for our dog-eared copy of the Stock Market Almanac, it turns out that it's highly unlikely…

The Almanac's tracking of of these rare events - as it admits - shows no clear connection between solar eclipses and stock market movement (see chart). Although it does offer a sliver of hope for fans of stock market anomalies, by teasing: “…if one was so minded, one can see some correlation on occasions."

There are echoes here of a not entirely unrelated research paper by the esteemed Professor Robert Novy-Marx. He showed that, if you really wanted to, you could credit global warming, the El Nino phenomenon, sunspot activity and the conjunctions of the planets for being powerful market predictors. In fact, Novy-Marx showed that the market performs significantly better when Mars and Saturn are opposed. It's highly tenuous, of course, which is exactly what Novy-Marx was getting at. With the proliferation of anomalies and easily obtainable data, it's possible to make some pretty outlandish connections.

This week at Stockopedia, Ed Croft examined some useful mental models that you can use to understand the nature of stocks and what might be worth watching out for. Meanwhile, our small cap expert Paul Scott had his hands full, not least dealing with Synety's latest results. Elsewhere, we have been reading:

- Todd Wenning at Clear Eyes Investing on 5 signs of a good annual report

- Tim Richards at the Psy-Fi Blog on Why investors would do well to act more like scientists and less like credulous apes

- Lee Wild at Interactive Investor on the Winners and losers from this week's Budget

- Ben Carlson at A Wealth of Common Sense on What's right with finance (and Morgan Housel of TMF on What's wrong with finance)

- James Surowiecki in The New Yorker In praise of short sellers

- Vitaliy Katsenelson in Institutional Investor on How emotional intelligence can…