I recently did an article on Debenhams, where a private equity consortium bought the firm in 2003. It re-floated three years later. 13 years later, shareholders are nursing a 70% capital loss!

So, I start investigating some UK IPOs because of the nature of private equity. Because they businesses to turn it around (general consensus) and offload it to others. These buyers are private investors or offload to the market at premium valuation (in most cases).

The intention is not to demonise Private Equity role in offloading businesses to the IPOs market. But, whether retail investors can profit from them private equity-backed IPOs.

Next, we explore the red flags signalling to retail investors to sell, or not take part in the IPO.

P.S. It is not an in-depth research, but gets people discussing the topic.

Let’s begin.

Are all private equity firms bad?

Well, they perform a necessary function of turning the businesses around. It can be closing down unprofitable stores, cutting staff numbers or reorganising debts to keep the business alive.

The issue people have is the use of leverage.

For example, Debenhams had £100m in debt before their private equity takeover. And within three years, Debenhams owe £1.9bn. Even worse, is the business didn’t expand, so no reason for it to borrow huge amounts of money.

Other UK Businesses with Private Equity connections

Bonmarche

on Sales?

Bonmarche was part of The Peacock Group before the group went into administration. Bought by an affiliate of Sun European Partners LLP called BM Holdings Management S.A.R.L & Partners S.C.A in 2012.

The price tag: £10m.

What happened?

Sun Partners affiliate bought a part of Bonmarche. (The brand closed 160 stores with a loss of 1,400 jobs.) The closure of loss-making stores helped turned the business around. 18 months later, it raised £40m in the stock market, valuing its IPOs at £100m.

900% in 18 months, crazy right!

For Sun European Partners, it offers 20m shares to investors at 200p each or £40m, an instant 300% profit!!! It still controls 52% of the shares.

What happened to Bonmarche since the IPO?

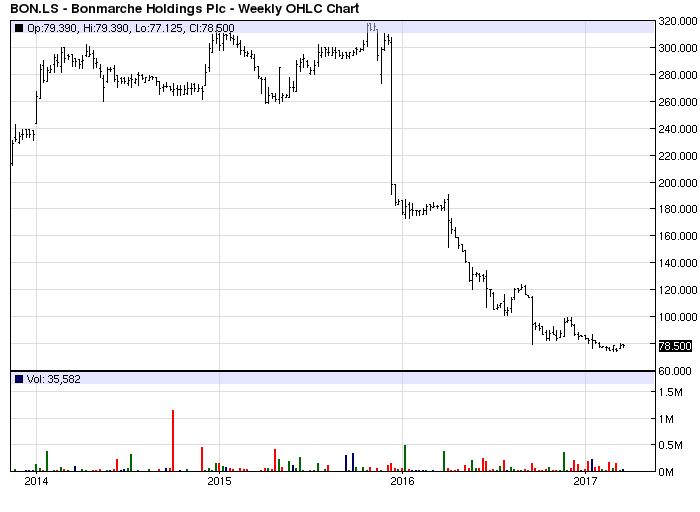

Shareholders weren’t pleased when shares tumbled by 65% to 77

pence, valuing it at £39m. According to the company, this is down to the warm

weather causing like-for-like sales to drop by 8%!

Shareholders weren’t pleased when shares tumbled by 65% to 77

pence, valuing it at £39m. According to the company, this is down to the warm

weather causing like-for-like sales to drop by 8%!

On Sun Partners’ financial stake on Bonmarche. Even if they…