The recent share price volatility has rocked investors all around the world. The FTSE is now officially in correction mode, 11.5% down on just a couple of months ago with another terrifying plunge today. The viciousness of these price falls has led to huge trading volumes on exchanges as stop losses are hit and investors readjust their portfolios for seemingly escalating risk. At times like these shouldn't we just run for the exits?

The beast on wall street

Regular readers will know that I'm a fan of the late Professor Robert Haugen's work. Robert Haugen was one of the great financial academics who railed against the idea of efficient markets. Sadly much of his work has gone underappreciated by his peers due to his tendency for polemic, though more recently the rise of low-volatility funds has seen his star re-emerge.

One of the lesser known books he wrote was titled "Beast on Wall Street... how stock volatility devours our wealth". In it he illustrated with his custom panache how the prices of stocks are far more volatile than their underlying fundamentals can explain. What he found was that price volatility begets price volatility. The market watches and feeds on itself... to such an extent that it tends to be excessively volatile. He called this excess volatility 'the beast'.

During major volatility bursts I frequently get calls from the media asking for an explanation for the stock market's strange behaviour. In the case of 1987, they seemed to want to pin it on the federal deficit. Nonsense... The market was just going through a process of "scaring itself to death". It had done that many times before, and will do it many times again. The key thing to watch for is the dissipation of price-driven volatility. If it goes away things will be fine. And if it doesn't...

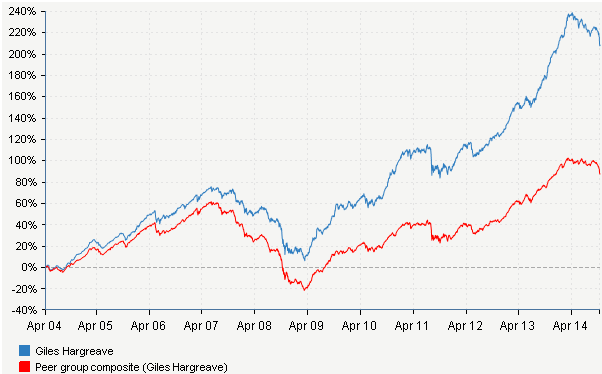

It's this excess volatility in the stock market which freaks everyone out, separates weak hands from their holdings and ensures that the stock market remains, on average, under-invested in. One of the main reasons the stock market outperforms other asset classes over the long term is how frightening the beast of volatility can be. It scares most investors off.

The press are of course scratching around to rationalise where this volatility is coming from. Ebola, German GDP, growth stutters, QE tapering etc etc. But this is what Nicholas Naseem Taleb in Black Swan calls…