The fall in oil prices has led to massive falls in the share price of oil producers, even the ones in production have seen its shares fell by at least 50%.

As there are quick changes to the oil market right now, I felt it would be interesting to investigate the hidden gems in the oil and gas sector.

Here is what I am going to cover:

1. A brief summary of the decline in the oil price.

2. Financial and oil metrics on current oil producers (mid-size capitalisation, mostly).

3. Brief analysis of each selected oil and gas producer.

4. Projection of how these oil producers will cope if the oil price trades at $60/barrel.

5. Who are the best oil producers, out of the bunch?

Recently, OPEC has refused to cut its level of production last week, and the oil market suffered.

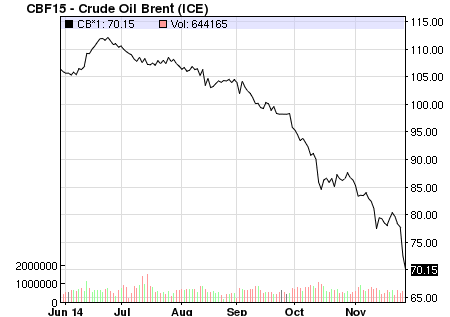

In fact, one could say the oil market is in 'financial turmoil', let alone a bear market, given the dramatic falls in the last three months.

Here is the chart for Brent Crude, in the last six months:

(Source: www.nasdaq.com)

Oil only started to fall more rapidly since September from $104/barrel to the current $70/barrel (03/12/14). This represented a fall of 33% in slightly less than three months.

A 33% fall means 33% less oil revenue for oil producing companies, and some of them, for sure, will not survive at this level.

But I am not in the business of speculating where oil prices will go in the future.

However, I believe if oil prices continue to stay around $70, or hover lower in the next 12 months there will be serious casualties. Some will be shut down from the equity and debt market.

In this scenario, the explorers, those with high levels of debt, and high cost per barrel will be the ones to fall first.

The fall in oil price is a fortune in disguise.

Because you should stop researching the oil explorers (unless its share price fell by 99%, a speculative frenzy may occur) and focus on the oil producers.

The reason is the oil producers are also collapsing in value. And the longer oil stays low; the lower these oil producers’ valuation will be lower.

Which companies will survive?

There’re so many oil producers listed in…