The oil price decline which began in 2014 has not been good news for BP’s share price. More importantly, cheap oil has also seriously undermined the company's dividend.

For now BP has maintained its dividend, but how long can that last in the face of dwindling revenues, profits and cash flows?

Death, taxes and BP’s dividend

In the good old days BP’s dividend was about as certain as death and taxes.

For decades, cautious and income-seeking investors could rest safe in the knowledge that every quarter a new dividend would be paid, and that most of the time it would go up ahead of inflation.

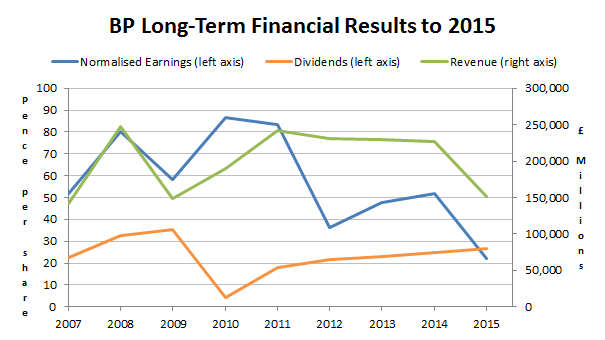

That picture was well and truly smashed in 2010 when the Gulf of Mexico oil spill led to BP’s dividend being suspended for three quarters. When it was finally reinstated, it was half the dividend it used to be.

But in the wake of that disaster BP managed to pull off a near miraculous recovery, driven by a mixture of asset sales on a massive scale (around $75 billion since 2010) and a supportive (i.e. high) oil price.

The post-disaster recovery has been so successful that today the dividend, on a per share basis, stands almost level with its all-time high from 2009.

However, after the oil price collapse the company’s dividend is no longer covered by underlying profits or free cash flows, which means that unless the situation improves the dividend is not sustainable at its current level.

Dividend uncertainty in the short-term

Fortunately there are ways and means by which companies can maintain their dividends, even if they are not currently affordable.

For example, companies can reduce cash outflows by reducing capital expenses or by simplifying the organisation to make it more cash efficient. Alternatively they can generate additional cash by selling off less profitable operations.

BP’s proposed financial framework for 2015-2017 makes use of each of those actions in order to balance the company’s sources and uses of cash over the next few years.

Even with all of those actions the company’s cash flows will only sustain the current dividend if oil is priced at $60 per barrel or above (today the oil price is below $40). If oil doesn’t reach that level, or if the plan is not successful for some other reason, it is very likely that the dividend will be cut.

So the question is: how likely is it that oil will be back above $60 per barrel…