For those who don’t what PayPoint PLC does, then take a look at this image:

Nowadays, PayPoint is more sophisticated as it handled the returns of delivery under the brand “Collect+”, which has over 6,000 retailers. They operate 4,200 LINK-branded ATMs and a leader in contactless payments technology (which they recently sold).

Despite all this, PayPoint’s share price remains static for four years. The main concern is the change in their business structure that cumulated towards the disposal of two assets:

- In 2016, it sold their online business consisting of PayPoint.net and Metacharge for £14m to Capita;

- In 2017, they sold their mobile payment services for £26.5m to Volkswagen Financial Services in a deal advised on by Mills & Reeve.

The sale of these businesses affected net profit, when they reported a net loss of £2m in 2016, as the result of goodwill write down by £50m. A look at their latest interim result shows the company made an operating profit close to £25m vs. £3.5m last year.

By tomorrow, profits should be back to normal.

Let’s talk about their valuation before moving onto their fundamentals.

Valuation at PayPoint is at fair value

I’m going to ignore the usually market metric valuations to save time.

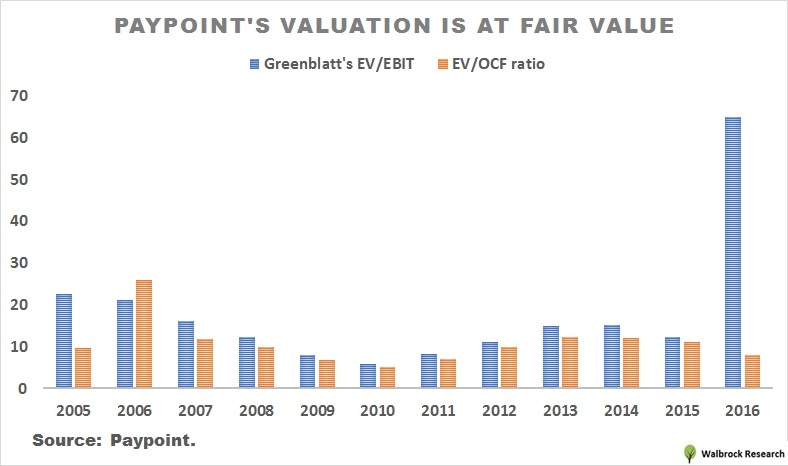

A fairer way to value PayPoint is the use of enterprise value as your numerator, that’s why I choose to use EV/EBIT and EV/OCF (operating cash flow) ratios.

Using the Greenblatt’s EV/EBIT ratio, it shows that valuation is at their lowest since 2011 (without the writedown, the ratio is closer to 9 times). A similar valuation appears on EV/OCF.

The low valuation was a product of PayPoint’s shares trading at a range between £7.60 per share and £12 per share for the last four years.

Why is the valuation “fairly” low?One reason is investors are “revenue-focused.” What I meant is, they placed a paramount importance on sales growth for tech businesses.

For PayPoint, sales have gone nowhere for eight years, but profit margins grew.

Second, is the uncertainty around their business structure. Now, we know Paypoint has sold off their online and mobile payment division.

It can now move forward and look to build-up their brand recognition.

PayPoint’s Stagnating Revenue and rising margins

Over the course of 11 years, revenue at PayPoint…