April 2015 will mark a seismic change to UK pensions when the obligation to buy an annuity will be removed. Although tax treatment needs to be considered, investors will have a lot more freedom over how to invest their pension fund. Many will be seeking alternatives to the historically low rates currently offered by annuities, which are largely a function of the high prices paid for government debt as a consequence of quantitative easing. The UK government only pays interest at 1.4% on money it is borrowing for 10 years, but that is good compared to the 0.4% offered by the German government.

These low annuity rates are likely to spur some investors to look at equities as an alternative asset class for income. The publication last week by Capita of its quarterly dividend review is a reminder of how large this market is. In 2014 UK companies paid out £97 billion in dividends, which gives the market as a whole a trailing yield of 4.3%. Perhaps even more important is that the amount paid out by UK companies over the 5 years from 2009 increased by 65%.

Prospective pensioners looking to secure an income for the rest of their lives, which could be another two or three decades, will be keenly aware that cost of living rises over time due to the insidious effects of inflation. So not only do they need to find a good income, they need to have some confidence that it will rise over time to provide protection from rising prices.

Traditionally this return could be found in equity income funds where dividends from shares were bolstered by interest income from bonds. However, now that yields on bonds have dropped so much they are less appealing. Moreover, the temptation for managers to buy high yielding shares to achieve the desired income is always tempered by the knowledge that these stocks often have limited ability to grow their dividends.

Fortunately, smart-beta funds offer a solution to the dilemma of having to choose between good income now, but with little prospect of it increasing in the future, or a lower yielding fund that has more potential for income to rise.

Beta is shorthand slang for the return of the market as a whole which means anyone invested in a conventional tracker fund…

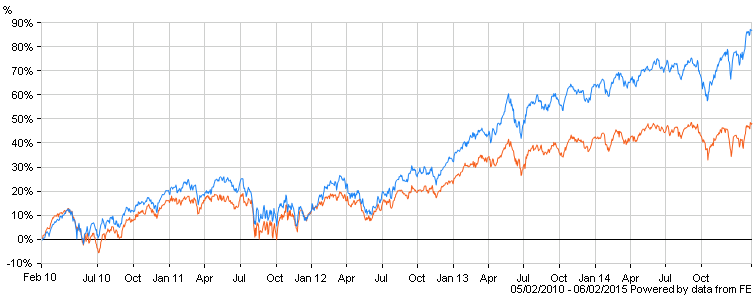

nice idea but over the last 5y the fund has under performed the ft100 on a tr basis and tracked it for the last 3y; so, what's teh point?

http://www.hl.co.uk/funds/fund-discounts,-prices--and--factsheets/search-results/v/vt-maven-smart-dividend-uk-x-accumulation/charts