I first reported on Zytronic (LON:ZYT) a year ago today, on my Blog, here. At the time I concluded that it seemed a good quality niche company (a UK manufacturer of bespoke electronic touch-screens), with a high operating profit margin of 21%, paying a decent dividend, with a sound Balance Sheet, but that the shares looked fully priced at the time, as I concluded;

So, a quality company, price is probably about right at the moment at 318p, but I'll be looking to buy on any big dips!

That was a good call, as the company warned on profits in May 2013, causing the share price to roughly halve, bumping along around 150p in the summer, and has since recovered somewhat to around 197p, as investor confidence has gradually returned, particularly after a more encouraging trading update issued on 9 Oct 2013.

Results for the year ended 30 Sep 2013 were published yesterday on 10 Dec 2013.

Helpfully, the company has published the investor results presentation on their website here, so rather than regurgitate that in this report, I will just draw my conclusions from it. So lots of useful information in that presentation, and I will assume that readers of this report have read it.

As expected, 2013 was a bad year, with underlying profit down from £4.2m to £2.4m. Underlying EPS was 13.9p, so that puts them on a PER of 14.2. There was a one-off non-cash adjustment to a royalty prepayment, which took profit before tax down to £1.9m, but I'm ignoring that, as it's a genuine one-off.

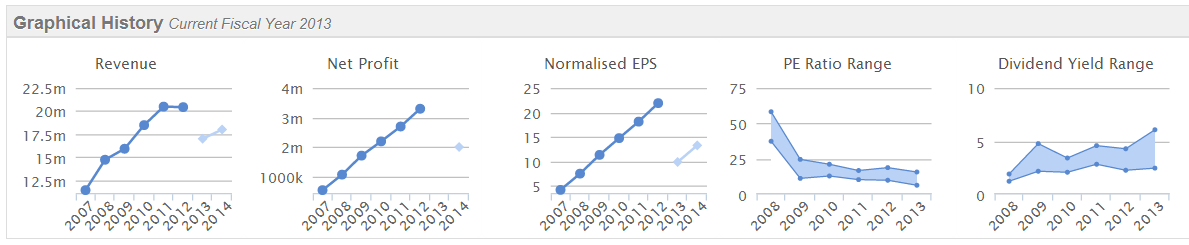

This Stockopedia graphic shows how the company's excellent track record has been badly damaged this year;

So what went wrong? I'm still not entirely sure, but it seems to have just been a case of some gaps opening up in the order book, and one major client in particular placed a large order that was delivered last year, but unexpectedly then placed no repeat orders this year. So with a shortfall in revenue, it had an operationally geared impact on the full year results. These things happen, especially with smaller companies.

Zytronic is a maker of bespoke touch-sensitive screens, and clearly has competitive strength, otherwise it wouldn't make the good profit margins it does. Also, costs are tightly controlled, being in the North East. Directors salaries are refreshingly sensible for example, compared with the excess we see all too often elsewhere with Listed companies.

I asked the Directors if they could modify their business model in some way, to make financial results more predictable, and they replied that they have to react to customer demand, and can't try to dictate to customers what they should order, and when. Visibility is limited, at typically 30 days, although a lot of business is repeat orders - i.e. Zytronic will design a bespoke touch screen for a client, who will then place regular repeat orders for that item for the next 3-5 years. So there is some short term lumpiness in sales, but also some long term predictability.

The company has a bulletproof Balance Sheet, and consistently generates cash, with net cash of £5.5m being quite material to the overall valuation - the market cap is about £30m at 197p per share, so the net cash equates to 37p per share. Strip that out, and the Enterprise Value comes down to 160p, which looks good value to me. The PER drops to only 11.5 if you take out the net cash.

The house broker is playing it safe with forecasts, with just 13.3p for the current year (ending 30 Sep 2014) and 14.7p next year. That's not ambitious at all, and personally I'll be looking for a better recovery, and have pencilled in 17p and 20p as the sort of EPS forecasts I'm looking for. Management will need a hefty kick up the backside if they can't deliver that.

So as investors we just need to understand and accept that the company trades well most of the time, and will have the occasional glitch in performance - which in my view gives a good buying opportunity.

The upside is in for free, and could be exciting - as Zytronic specialise in large, multi-touch screens, all bespoke. The bigger the screen, the bigger the margins, and one of the reasons 2013 disappointed is that sales of larger screens fell back. As economies improve, the capital cycle is likely to work in Zytronic's favour, and there's a decent chance they could start seeing improving trends develop.

The company mentioned that they are only currently working at 50% of capacity. So winning decent new contracts could have a pretty dramatic impact on profitability, if it happens.

So the best way to see this share is a good quality, niche company, generating decent profits (even in a bad year), throwing off cashflow, and paying a generous dividend.

Despite having a bad year, the total divis have been increased to 9.1p, giving an attractive yield of 4.6%. So I think it's worth holding just for the divis. Management seemed confident & relaxed to me in the meeting, and they pointed that deferred business in 2013 should provide an uplift in 2014. I like management here - they are down to earth, traditional hands-on management, who are just getting on with the job. So don't expect any fancy acquisitions, but just more product development and potentially some good growth in the pipeline.

I'm not expecting this share to shoot the lights out, but I reckon that, with patience, it should deliver a decent long-term return. The most exciting product in the pipeline is communal, interactive tables. So think in terms of gaming & entertainment consoles that might be a bit like a coffee table, with multiple users sitting around and interacting with it. The multi-touch technology that Zytronic has puts them in a strong competitive position, and they operate globally, with 94% of production being exported (edit: "exported" is now correct. Previously I said "outsourced", which was incorrect. My apologies for this typo).

There could also be plenty of opportunities in more advanced vending machines, which might interact with your mobile phone as you walk past, interactive digital signage, etc.

If they deliver a year of improved results as I hope for, then in 12 months' time we could be looking at a share price over 300p again. Add the dividends to that, and it's potentially a decent return.

The downside risk is protected by the strong Bal Sheet, and the dividends, which should protect the downside to about 20-25% risk from 197p perhaps, even if they have another disappointing year. Plus of course there is nothing forcing anyone to sell the shares, even if they do have another bad year, so I would simply ride out a bad year, and collect in the divis along the way. But remember that last year's poor H1 performance is this year's easy comparatives, hence why I think the newsflow might be better this year.

As always, please DYOR, this is not a recommendation, just my personal opinions.

Regards, Paul.

(I have no personal holding in Zytronic shares, but a Small Caps Fund to which I provide research does have a long position in these shares).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.