Can Cello Health provide both capital growth and dividend income?

Anybody who has watched Indiana Jones or Monty Python will know to beware holy grail-based quests. But what if we said that there was not only a holy grail in equity investing, but that the famed SocGen Global Equity team actually found it in 2012 (with a little help from Professor Piotroski...)?

The ‘SG Quality Income Index’ tracks yield and quality. Many in the market now appreciate that both higher ‘quality’ stocks and higher yielding stocks tend to outperform, but according to the research note, stocks that share both qualities put together standout total returns that have averaged 11.6% per year since 1990, more than doubling the return of the global equity markets at a significantly reduced volatility.

This 'holy grail' stock is, simply, one with a Piotroski F-Score of more than 7 and an above-average dividend yield. Using the financial data computed and included in Stockopedia's StockReports, we can instantly check whether our own stocks meet these criteria and screen the market for new candidates.

Let's take Cello Health (LON:CLL) as an example.

Checking the quality-income characteristics of Cello Health

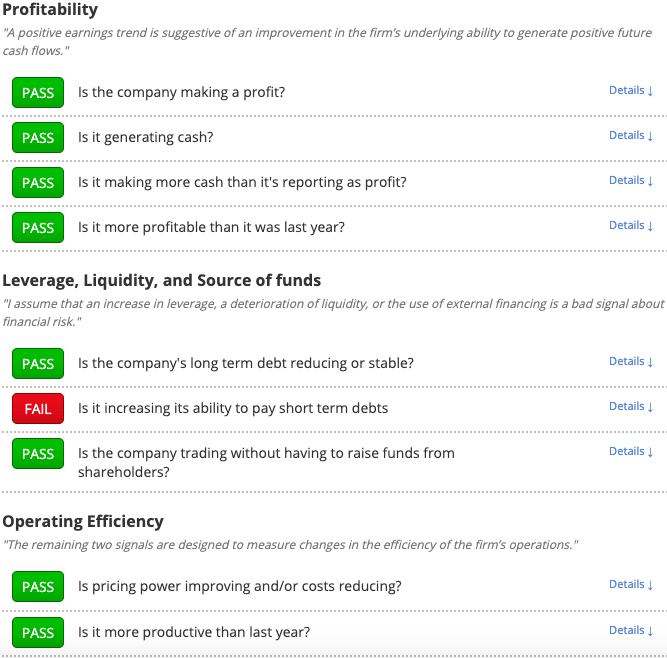

The first point to check is Cello Health's Piotroski F-Score. As mentioned above, any score above 7 gets this company past the first hurdle. A quick look at the group's StockReport shows a passing F-Score of 8.

Next up is the income check. Cello Health pays out a rolling dividend yield of 3.16% (covered 2.26 times) rising to 3.30%. A decent yield like this, coupled with an improving financial health trend, is a positive early sign.

What does this mean for potential investors?

Cello Health has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with Cello Health that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.