Checking up on the financial health of Acacia Mining (LON:ACA)

In investing, knowing which numbers you should pay attention to and which you should discard is half the battle. Honing in on the measures that tell us what’s really going on can save us a lot of time and pain. It also allows us to move faster than the competition.

At Stockopedia, we strive to identify these key measures. One of the most useful we have found so far is Piotroski’s F-Score - and the F-Score has good news for shareholders of mid cap super stock Acacia Mining (LON:ACA), which operates in the Basic Materials sector.

Acacia Mining is primarily engaged in the mining, processing and sale of gold and has a portfolio of exploration projects located across Africa.

Acacia Mining (LON:ACA): recent performance

For the fiscal year ended 31 December 2018, Acacia Mining PLC revenues decreased 12% to $663.8M and Net income totaled $58.9M vs a loss of $707.4M in the prior period after a 79% reduction in restructuring cost.

The market has welcomed this performance (see the chart below) and Acacia's shares have a one-year relative strength of 41.7%.

The group's shares are valued on an undemanding rolling PE ratio of 12.6 and it has net cash of £87.6m on its balance sheet, albeit alongside a patchy profitability track record - but has Acacia turned a corner?

Why the Piotroski F-Score matters

Followers of renowned accounting professor Joseph Piotroski are well aware of the checklist that made him famous in 2002. Piotroski is behind the F-Score: a simple indicator to highlight neglected stocks with improving prospects.

What's good about the F-Score is that it is essentially an entire quality and fundamental momentum screen in a single number, succinctly summing up the financial health trend of a company. Applying it as a filter on top of almost any strategy can help to increase returns and reduce risk.

Acacia Mining (LON:ACA)'s F-Score: what does it mean?

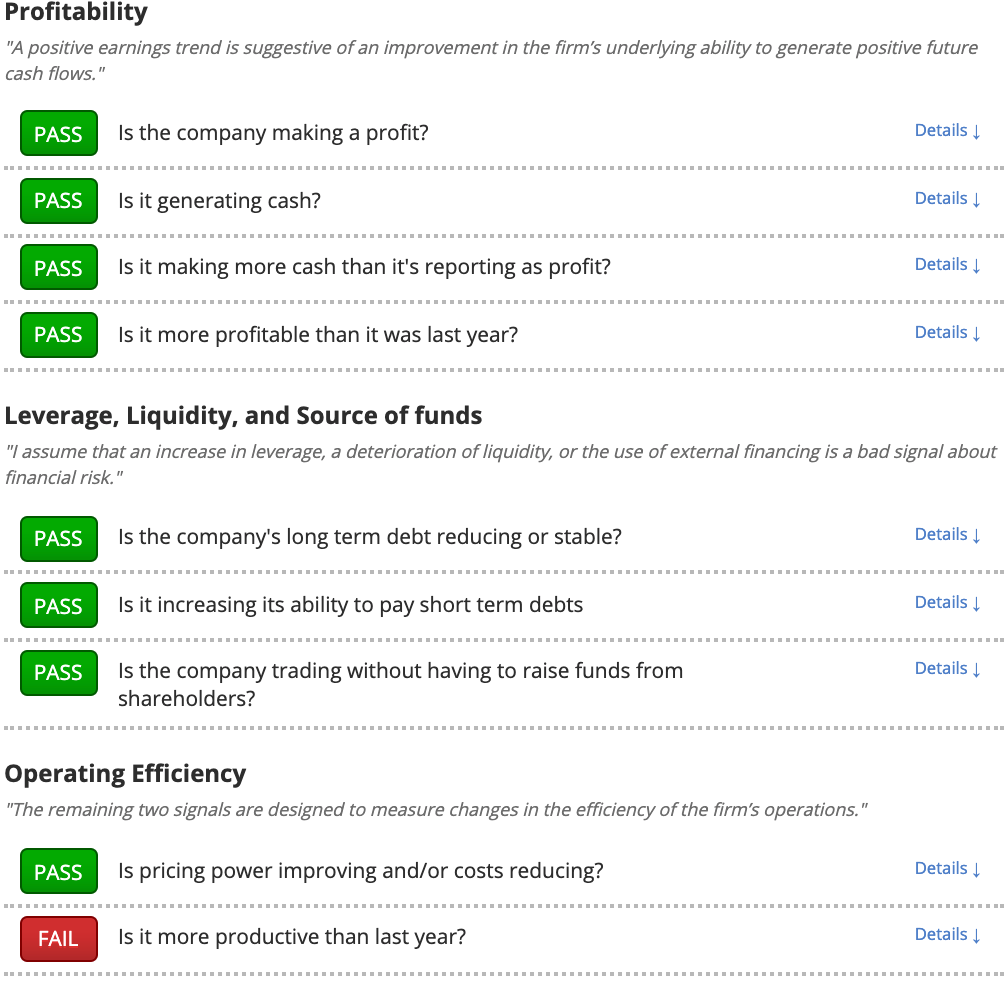

Acacia Mining (LON:ACA) scores 8 out of a possible 9. In his landmark academic paper "Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers", Piotroksi showed that by investing in companies scoring 8 or 9 by these measures over a 20-year test period through to 1996, investor returns could be increased by an astounding 7.5% each year. Below, you can see exactly how LON:ACA stacks up against the checklist

What does this mean for potential investors?

Acacia Mining has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with Acacia Mining that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.