Could improving financial trends drive the John Wood share price?

John Wood (LON:WG.) is a United Kingdom-based energy services company that provides a range of engineering, production support, maintenance management and industrial gas turbine overhaul and repair services to the oil and gas and power generation industries.

It operates through two segments: Wood Group Engineering segment, which provides a range of engineering services, such as conceptual studies and construction management, and Wood Group PSN segment, which provides production services to the upstream, midstream, downstream and industrial sectors through brownfield engineering and modifications, production enhancement, operations and maintenance, facility construction and maintenance management.One of the most useful measures for gauging a company's financial quality is Piotroski’s F-Score - and the F-Score has good news for shareholders of John Wood.

What's good about the F-Score is that it is essentially an entire quality and fundamental momentum screen in a single number, succinctly summing up the financial health trend of a company. Applying it as a filter on top of almost any strategy can help to increase returns and reduce risk.

John Wood's F-Score: what does it mean?

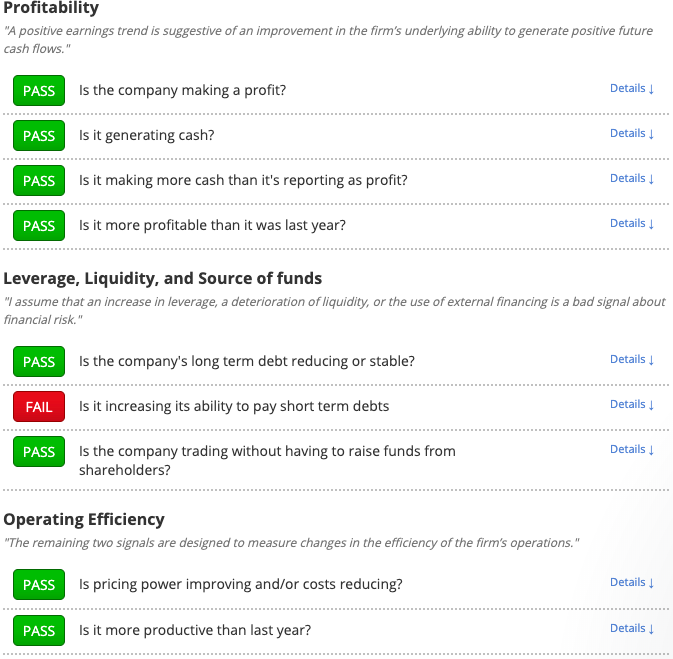

In the checklist below, we see that John Wood scores 8 out of a possible 9. In his landmark academic paper "Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers", Piotroksi showed that by investing in companies scoring 8 or 9 by these measures over a 20-year test period through to 1996, investor returns could be increased by an astounding 7.5% each year.

What does this mean for potential investors?

John Wood has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with John Wood that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.