Is Boral's (ASX:BLD) share price undervalued?

In investing, knowing which numbers you should pay attention to and which you should discard is half the battle.

At Stockopedia, we strive to identify these key measures. Here we take a couple of the more important measures and apply them to large-cap contrarian stock Boral (ASX:BLD), which operates in the Basic Materials sector.

Boral (ASX:BLD): strong recent performance

Boral is engaged in the provision of building and construction materials, dealing in everything from concrete to roof tiles and timber flooring. For the six months ended 31 December 2018, Boral Limited revenues increased 5% to A$2.93B and net income before extraordinary items increased 10% to A$190.4M .

Despite this performance, Boral's (ASX:BLD) share price has been in freefall and currently languishes at near 4-year lows as a result of a tougher housing market, which has caused a spate of construction industry insolvencies.

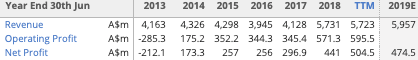

Boral itself expects H1 2019 core earnings to be slightly lower than last year, "affected by delays to major projects and infrastructure". However, if we put tough market conditions to one side, we can see that Boral has made steady underlying financial progress on a five-year view:

Earnings per share at Boral have grown at a compound annual growth rate of 18.3% on a three-year view and, although we might expect this growth trend to be disrupted moving forwards, the group's net gearing is not excessive at 38.5%. This suggests that, given its scale, balance sheet, and profitability, Boral stands a better chance than most to weather tough sector conditions.

Boral (ASX:BLD)'s F-Score: what does it mean?

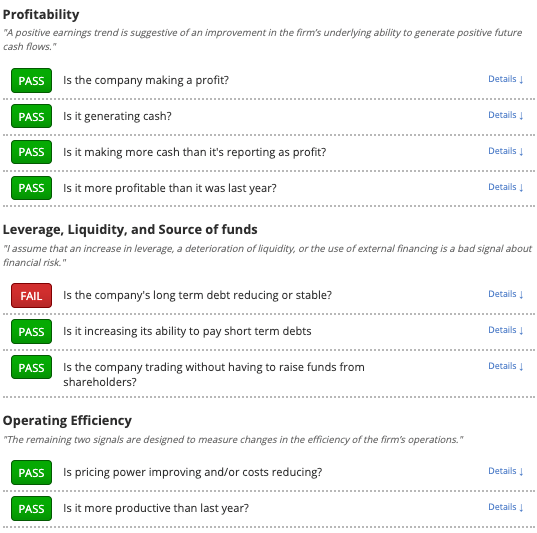

What's more, Boral (ASX:BLD) scores 8 out of a possible 9 on the Piotroski F-Score, which measures the trend in a company's financial health. A score of 8 indicates an improving financial position. In his landmark academic paper "Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers", Piotroksi showed that by investing in companies scoring 8 or 9 by these measures over a 20-year test period through to 1996, investor returns could be increased by an astounding 7.5% each year. Below, you can see exactly how ASX:BLD stacks up against the checklist.

The prospect of cyclical headwinds must not be understated. That said, and given the fact that Boral pays a rolling dividend yield of 5.52% that is reasonably well covered (1.59 times on a rolling basis), this construction materials company looks like an interesting candidate for long-term income investors.

What does this mean for potential investors?

Boral has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with Boral that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.