Is Dunelm (LON:DNLM) a worthy ISA candidate?

Screening for companies with strong balance sheets and solid dividend yields can be a quick and simple way of identifying potentially high-quality investments that might be attractively priced. One way of doing might be to include stocks that have a Piotroski F-Score of 8 or 9 and a dividend yield of at least, say, 3%.

Take Dunelm (LON:DNLM), for example, which is an adventurous high flyer company in the Consumer Cyclicals sector. Dunelm (LON:DNLM) pays out a rolling 3.05% of its share price in dividend payments.

Does Dunelm (LON:DNLM) pass our F-Score test?

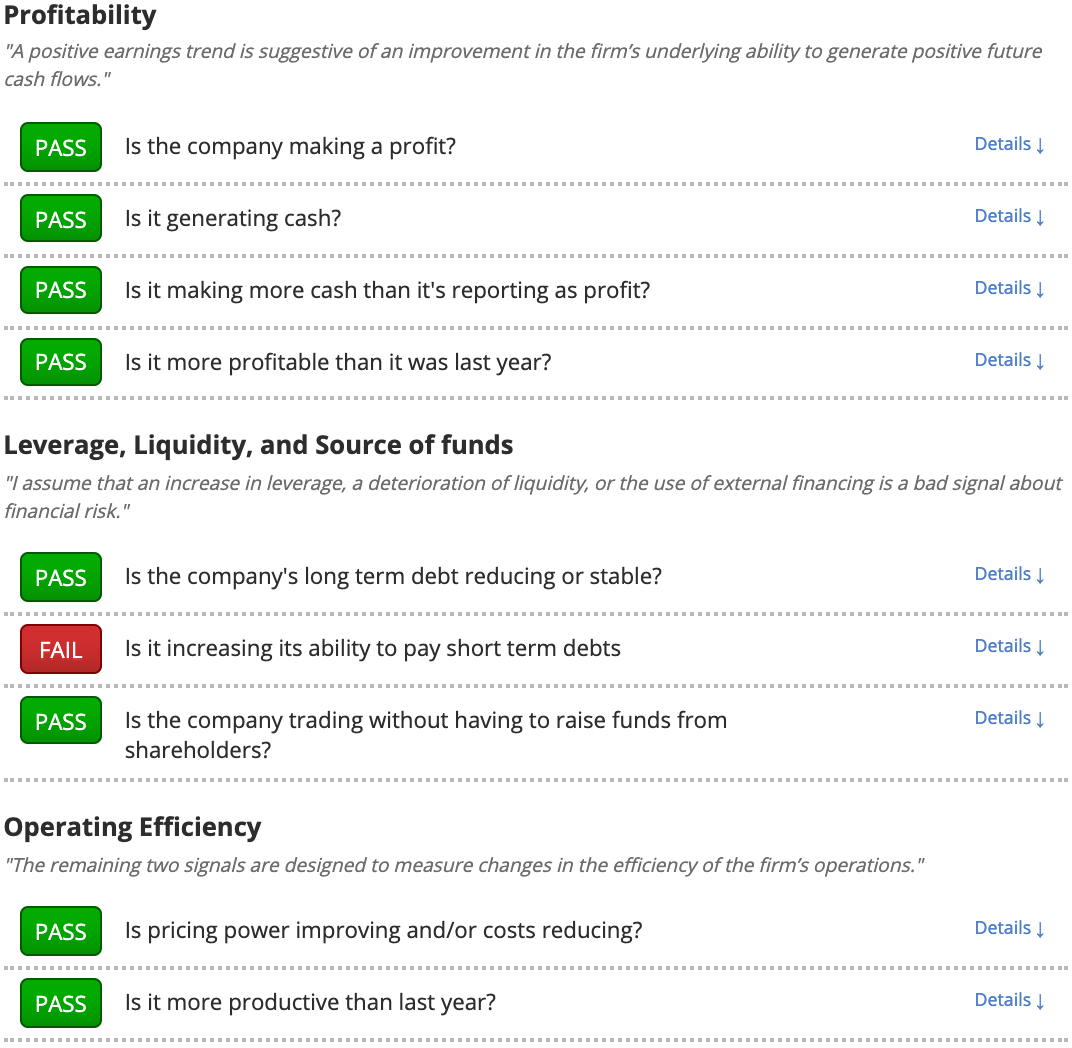

Stockopedia applies algorithms to its stream of financial data to automatically calculate the Piotroski F-Score for every stock on the market. It shows that Dunelm (LON:DNLM) scores 8 out of a possible 9.

By investing in companies scoring 8 or 9 by these measures, Piotroski showed that, over a 20-year test period through to 1996, the return earned by a value-focused investor could be increased by an astounding 7.5% each year. Even better, it suggests that the company is well-placed to continue to pay out attractive dividends.

Prospects for Dunelm (LON:DNLM)

Perhaps we can see why this is by looking at the company's most recent financial results. For the 26 weeks ended 29 December 2018, Dunelm Group plc revenues increased 1% to £551.8m and net income increased 24% to £55.8m.

Dunelm's improving financial condition, reasonable yield, and decent results justify further analysis.

What does this mean for potential investors?

Dunelm has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with Dunelm that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.