Is Melrose's share price being held back by these three financial risks?

Screening out weak balance sheets is one of the most effective ways of reducing risk in your portfolio.

One simple way to do this is to apply Stockopedia's take on the Altman Z-Score, a checklist that was found to be up to 80-90% accurate in predicting bankruptcy one year before the event in the 31 years up until 1999 in the original study. We can see it in action by applying it to Industrials group Melrose (LON:MRO).

What does the Altman Z-Score flag up about Melrose?

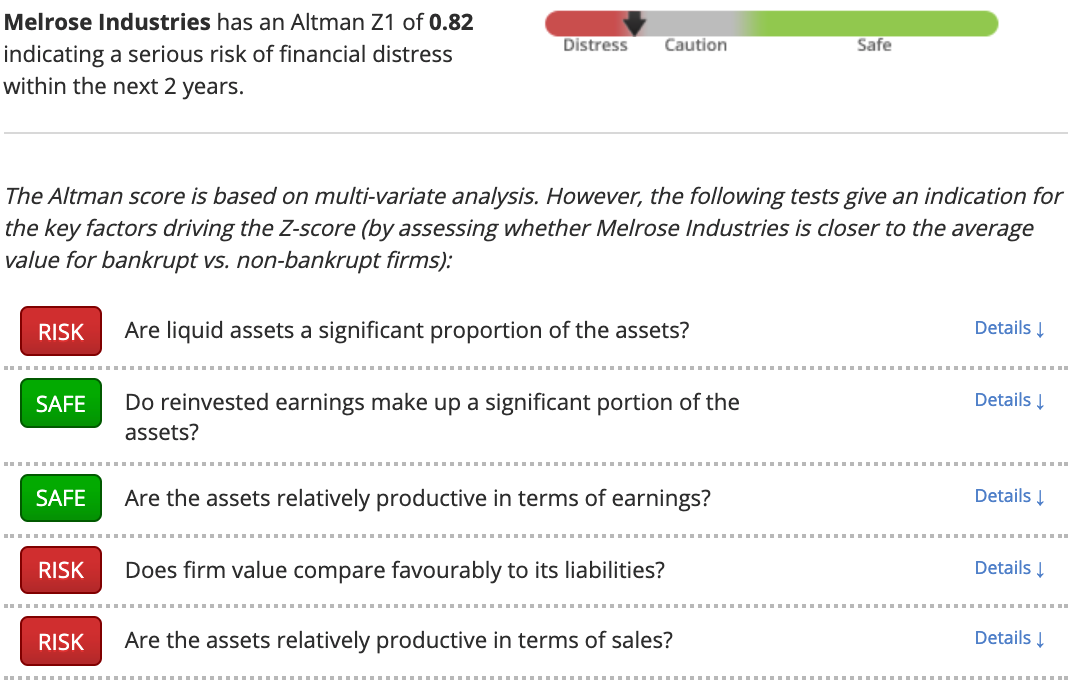

Unfortunately, Melrose Industries fails Altman’s test, with a worryingly low Z-Score of 0.82. This is well below the distress threshold of 1.8... Melrose's low Z-Score doesn't mean that it is definitely heading for financial distress, but it does mean this fate is more of a risk for Melrose than it is for most.

Here's exactly how Melrose fails the Z-Score:

Next Steps

To find more stocks like Melrose Industries, you'll need to equip yourself with professional-grade data and screening tools to pinpoint the highest quality companies in the market. This kind of information has traditionally been closely guarded by professional fund managers. But our team of financial analysts have carefully constructed this screen - which gives you everything you need.

In less than a minute, you can be exploring a list of stocks with the very strongest financial ratios in the market. You'll be joining us on a journey towards owning the very best quality stocks possible. So what are you waiting for? Come and get started for free.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.