Is Qantas Airways' (ASX:QAN) share price heading for turbulence?

Legendary stock trader Paul Tudor Jones once said: “At the end of the day, the most important thing is how good are you at risk control."

Yet it is all too easy to get carried away with the future prospects of a company without paying enough attention to the boring reality of how its finances shape up today. A solid grasp of risk and prudent risk management policies are often what separates a good investor from a great one.

Luckily it is not as hard as you might think to upgrade your risk management systems. Simple checklists can make for surprisingly effective screens. For example, one of the most famous balance sheet checklists was found to be:

- 72% accurate in predicting bankruptcy two years prior to the event in its initial test, and

- 80-90% accurate in predicting bankruptcy one year before the event in the 31 years up until 1999

These results are for the Altman Z-Score, which measures the degree to which a stock resembles companies that have gone out of business in the past. Steering clear of this type of stock could save us a lot of pain in the long run.

What it says about airline operator Qantas Airways (ASX:QAN) might well be keeping the group’s chief financial officer, Tino La Spina, up at night...

Does Qantas Airways (ASX:QAN) pass the Altman Z-score test?

The Altman Z-Score was developed by New York University finance professor and leading academic, Edward I. Altman. In 1968, the celebrated professor struck upon a combination of five weighted business ratios that is used by investment managers and hedge funds to this day.

Interpreting the Z-Score is simple. Any Z-Score above 2.99 is considered to be a safe company, while those with a Z-Score of less than 1.8 have been shown to have a significant risk of financial distress within two years.

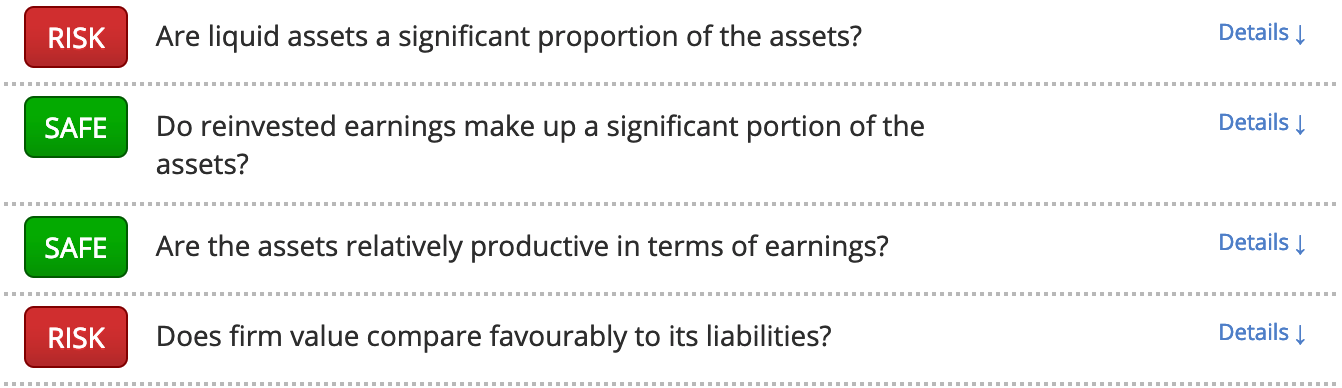

If we apply it to Qantas Airways (ASX:QAN) what do we get? A Z-Score of -0.26 - well below the cut-off point that signals potential distress. Here is a snapshot of where exactly the company fails:

Using the Z-Score to protect your portfolio

The Z-Score has proven very effective in predicting business distress. It measures how closely a firm resembles other firms that have filed for bankruptcy by looking for red flags in the following areas:

- Current assets as a proportion of total assets,

- Cumulative profitability and use of leverage,

- Productivity of assets, and

- Firm value compared to liabilities

Steering clear of stocks that fail these checks means you are avoiding companies that exhibit similar financial characteristics to companies that have gone bankrupt in the past, often as a result of having a weak balance sheet.

Fund manager Anthony Bolton once said: "When I analysed the stocks that have lost me the most money, about two-thirds of the time it was due to weak balance sheets. You have to have your eyes open to the fact that if you are buying a company with a weak balance sheet and something changes, then that’s when you are going to be most exposed as a shareholder." Using the Z-Score to identify this type of stock seems like a smart way to avoid similar mistakes.

Qantas Airways' (ASX:QAN) weak Z-Score and its A$3,283M of net debt, along with the airline industry's reputation as a cyclical sector with heavy capital expenditure demands and significant off-balance sheet assets and liabilities, should serve as a reminder to investors to be aware of the risks they allow into their portfolios.

Next Steps

To find more stocks like Qantas Airways, you'll need to equip yourself with professional-grade data and screening tools to pinpoint the highest quality companies in the market. This kind of information has traditionally been closely guarded by professional fund managers. But our team of financial analysts have carefully constructed this screen - which gives you everything you need.

In less than a minute, you can be exploring a list of stocks with the very strongest financial ratios in the market. You'll be joining us on a journey towards owning the very best quality stocks possible. So what are you waiting for? Come and get started for free.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.