Is Sirius Minerals' weak balance sheet cause for concern?

Business distress and bankruptcy can put a dent in your portfolio no matter how well diversified you are.

The Z-Score was developed by New York University finance professor and leading academic, Edward I. Altman. It measures how closely a firm resembles other firms that have filed for bankruptcy by considering the following areas:

- Current assets as a proportion of total assets,

- Cumulative profitability and use of leverage,

- Productivity of assets, and

- Firm value compared to liabilities

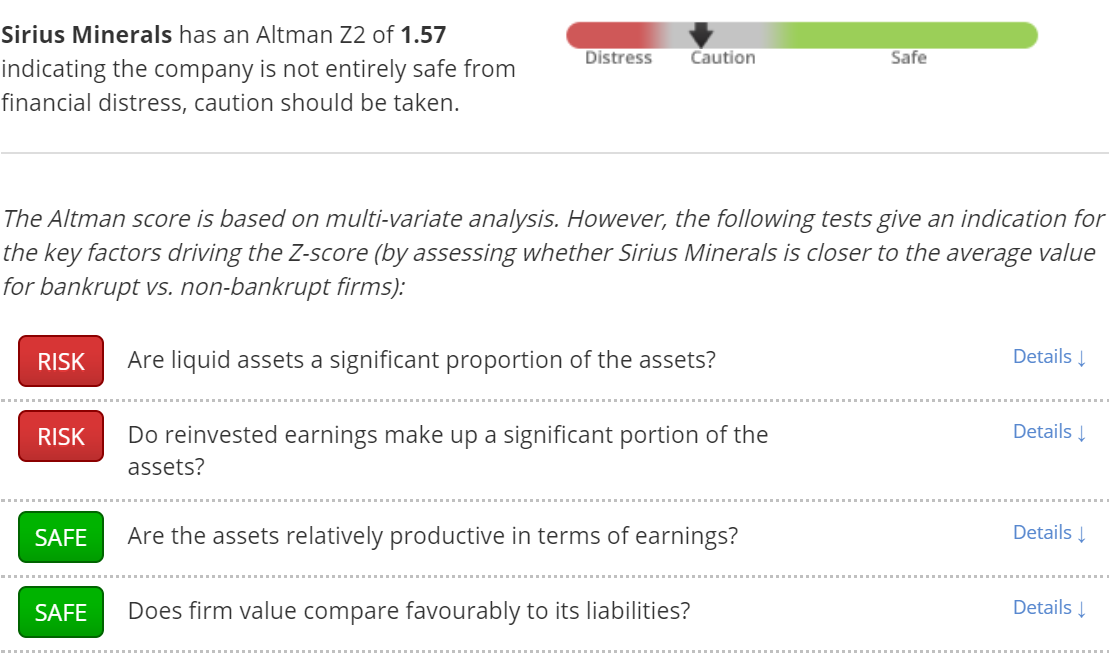

A Z-Score of more than 2.99 is considered to be a safe company. Those with a Z-Score of less than 1.8, on the other hand, have been shown to have a significant risk of financial distress within two years. We can see the checklist in action by applying it to a listed company. Take popular mid cap potash play Sirius Minerals (LON:SXX), for example.

How does Sirius Minerals fare against Altman’s influential checklist?

What does the Altman Z-Score flag up about Sirius Minerals?

Unfortunately, Sirius Minerals fails Altman’s test, with a low Z-Score of 1.57...

Sirius Minerals's low Z-Score doesn't mean that it is definitely heading for financial distress, but it does mean we should be aware of the risks with this pre-revenue stock.

Specifically, our algorithms flag the following as risks:

In 2009, Morgan Stanley strategy analyst, Graham Secker, used the Z-score to rank a basket of European companies. He found that the companies with weaker balance sheets underperformed the market more than two-thirds of the time. This quick look at Sirius Minerals shows that it also has weak spots that require further investigation.

Next Steps

To find more stocks like Sirius Minerals, you'll need to equip yourself with professional-grade data and screening tools to pinpoint the highest quality companies in the market. This kind of information has traditionally been closely guarded by professional fund managers. But our team of financial analysts have carefully constructed this screen - which gives you everything you need.

In less than a minute, you can be exploring a list of stocks with the very strongest financial ratios in the market. You'll be joining us on a journey towards owning the very best quality stocks possible. So what are you waiting for? Come and get started for free.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.