Is Spire Healthcare (LON:SPI)'s weak balance sheet cause for concern?

Business distress and bankruptcy can put a dent in your portfolio no matter how well diversified you are.

That's why paying attention to simple checklists that flag up risky stocks is so important. Stockopedia provides many of these screening tools to help investors safely navigate the stock markets. One of them - the Altman Z-Score - was found to be:

- 72% accurate in predicting bankruptcy two years prior to the event in its initial test

- 80-90% accurate in predicting bankruptcy one year before the event in the 31 years up until 1999

Take mid cap contrarian Spire Healthcare (LON:SPI), for example. The Company provides in-patient, daycase and out-patient care from approximately 40 hospitals, 10 clinics and over two specialist care centers across the United Kingdom. How does it fare against Altman’s influential checklist?

What does the Altman Z-Score flag up about Spire Healthcare (LON:SPI)?

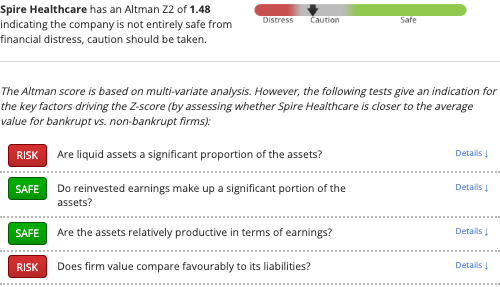

Unfortunately, Spire Healthcare fails Altman’s test, with a Z-Score of 1.48 - below to 1.8 cutoff point that signals a risk of imminent financial distress...

Spire Healthcare's low Z-Score doesn't mean that it is definitely heading for trouble, but it does mean this fate is more of a risk for Spire Healthcare than it is for most.

Specifically, our algorithms flag the following as risks:

In 2009, Morgan Stanley strategy analyst, Graham Secker, used the Z-score to rank a basket of European companies. He found that the companies with weaker balance sheets underperformed the market more than two-thirds of the time.

Spire's recent financial performance fails to allay these fears: for the fiscal year ended 31 December 2018, Spire Healthcare Group PLC revenues decreased less than 1% to £931.1M and Net income decreased 33% to £11.3M. The group's poor Z-Score suggests that it will struggle should income continue to fall.

Next Steps

To find more stocks like Spire Healthcare, you'll need to equip yourself with professional-grade data and screening tools to pinpoint the highest quality companies in the market. This kind of information has traditionally been closely guarded by professional fund managers. But our team of financial analysts have carefully constructed this screen - which gives you everything you need.

In less than a minute, you can be exploring a list of stocks with the very strongest financial ratios in the market. You'll be joining us on a journey towards owning the very best quality stocks possible. So what are you waiting for? Come and get started for free.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.