The Mysale share price: further downside at 2.6p?

Even if accounting errors or red flags are innocent, the market response is usually swift and severe. Uncertainty about a company's earnings or the way it reports its figures will inevitably cause its share price to plummet.

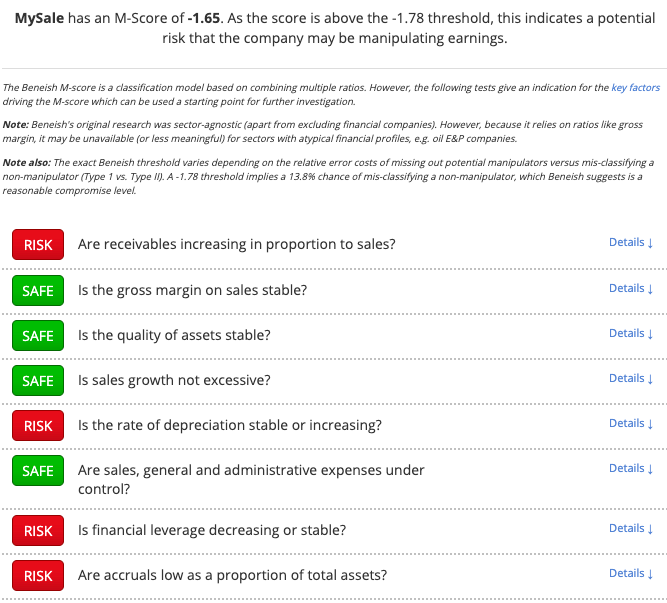

What most investors don’t realise is that there are algorithmic ways to check the credibility of company earnings - and one of them is called the Beneish M-Score. The indicator is a statistical measure derived from a set of 8 ratios drawn from a company's accounts.

In this article, I’m going to explain how it works by looking at Mysale (LON:MYSL) as an example.

About Mysale

Mysale is a highly speculative, micro cap in the Internet Services industry. Its share price is now deeply distressed and has a 1-year relative strength against the FTSE All-Share index of -94.4%.

The group is currently loss-making and this trend is set to continue in FY19, although some brokers are forecasting a swing to profitability in FY20.

The Beneish M-Score - which I’ll explain shortly - shows that there are areas in Mysale's accounts that might be worth closer investigation.

It's important to note that this doesn’t mean that Mysale is doing anything wrong. But it does mean that the risks could be higher than for other shares. As an investor, you should know what these red flags mean - both in Mysale and any other stock you might be thinking of buying.

Are there accounting risks at Mysale?

Here is a graphic that shows how Mysale stacks up against the M-Score checklist.

Next Steps

To find more stocks like Mysale, you'll need to equip yourself with professional-grade data and screening tools to pinpoint the highest quality companies in the market. This kind of information has traditionally been closely guarded by professional fund managers. But our team of financial analysts have carefully constructed this screen - which gives you everything you need.

In less than a minute, you can be exploring a list of stocks with the very strongest financial ratios in the market. You'll be joining us on a journey towards owning the very best quality stocks possible. So what are you waiting for? Come and get started for free.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.