Should investors worry about accounting red flags at Ceres Power Holdings (LON:CWR)?

Every shareholder should be able to rely on the accounts of their companies but, sadly, this is not always the case.

The market response to 'accounting errors' is usually swift and severe. Uncertainty about a company's earnings or the way it reports its figures will inevitably cause its share price to plummet.

There are algorithmic ways to check the credibility of company earnings. One of them is called the Beneish M-Score. In this article I’m going to explain how it works by looking at Ceres Power Holdings (LON:CWR) as an example.

About Ceres Power Holdings (LON:CWR)

Ceres Power Holdings is a speculative, small cap in the Renewable Energy Equipment & Services industry.

In terms of price performance, the Ceres Power Holdings share price has seen 1-year relative strength against the FTSE All-Share index of 20.6%.

When it comes to earnings, analysts are currently forecasting that Ceres Power Holdings' earnings per share will grow by % in the current financial year.

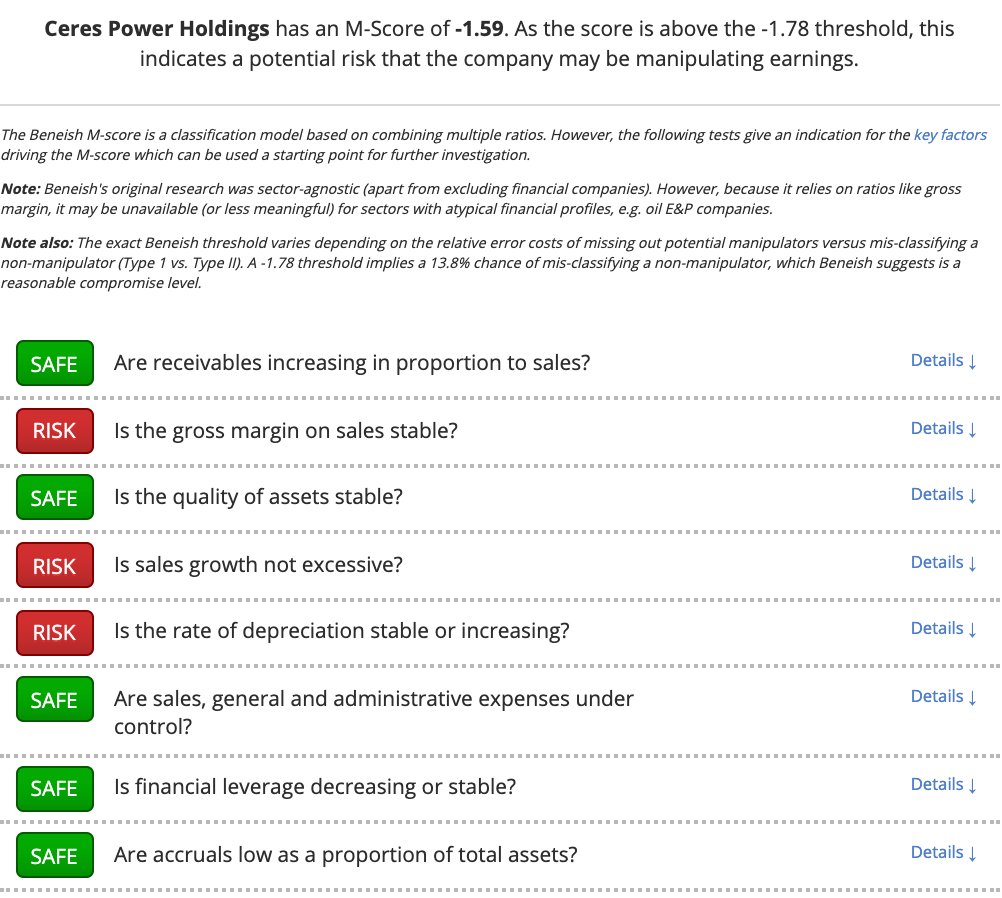

While those figures sound promising, the Beneish M-Score - which I’ll explain shortly - shows that there are areas in Ceres Power Holdings' accounts that might be worth closer investigation.

It's important to note that this doesn’t mean that Ceres Power Holdings is doing anything wrong. But it does mean that the risks could be higher than for other shares. As an investor, you should know what these red flags mean - both in Ceres Power Holdings and any other stock you might be thinking of buying.

How the Beneish M-Score works

In 1999, a finance professor called Messod Daniel Beneish published a landmark research paper entitled The Detection of Earnings Manipulation. It showed how you can use accounting data to spot problems early.

Since then it’s become an indispensable checklist for professional money managers and investment banks - and you can use it too.

Professor Beneish’s M-Score looks at the year-on-year change in eight different ratios that can be worked out from a company’s financial statements. It looks for these red flags:

- Inflated revenues

- Declining gross margins

- Capitalised and deferred costs

- Excessive sales growth

- Lengthening depreciation periods

- Rising sales expenses

- Increasing leverage

- Higher accruals

Ideally, you and I would want our stocks to be passing these checks with ease. But when a company fails one or more of them, it’s time to dig deeper into the accounts to find out why.

Are there accounting risks at Ceres Power Holdings?

Here is a graphic that shows how Ceres Power Holdings stacks up against the M-Score checklist.

Next Steps

To find more stocks like Ceres Power Holdings, you'll need to equip yourself with professional-grade data and screening tools to pinpoint the highest quality companies in the market. This kind of information has traditionally been closely guarded by professional fund managers. But our team of financial analysts have carefully constructed this screen - which gives you everything you need.

In less than a minute, you can be exploring a list of stocks with the very strongest financial ratios in the market. You'll be joining us on a journey towards owning the very best quality stocks possible. So what are you waiting for? Come and get started for free.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.