Should value investors consider the Firstgroup share price (LON:FGP)?

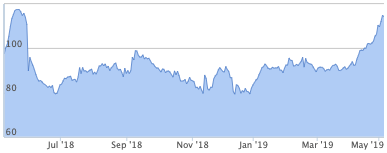

Firstgroup (LON:FGP) is a mid cap bus and train operator that has, for a long time, been one of those turnarounds that can't quite turnaround. Over the past month, however, its share price has shown signs of life:

And this positive momentum is driving an improvement in Firstgroup's StockRank, which now sits at 87. Alongside momentum, two other factors contribute to our StockRanks: value and quality. Here, we take a quick look at Firstgroup's Value Rank to see what this indicator says about the group's shares.

The Value Rank: how does Firstgroup stack up?

We can see by using Firstgroup’s StockReport that it has a:

- Rolling price to book value of 0.82,

- Rolling price to earnings ratio of 8.58

- Trailing twelve-month price to free cash flow of 8.93

- Rolling dividend yield of 0.000%

- Trailing twelve-month price to sales ratio of 0.20

When we add all of these together, we find that Firstgroup has a Value Rank of 75. Investing in high-value stocks requires finesse and a sturdy constitution but, when cheap stocks come good, the payoff can be large and sudden.

Firstgroup’s Value Rank of 75 puts it in the cheapest quartile of the stock market. That is certainly a promising jumping off point for our analysis but it is not the whole story.

A smarter way to invest in value stocks is to find the best quality value stocks or value stocks whose share prices are turning around - history shows that you can do much better than a passive investor by combining factors, so it makes sense to consider Firstgroup’s Value Rank alongside its Momentum and Quality Ranks. You can see these Ranks on the group's StockReport page.

What does this mean for potential investors?

Some of the best quality stocks in the market have defensible models that can deliver high levels of shareholder returns over the long term. But there are no guarantees and it's important to do your own research. Indeed, we've identified some areas of concern with Firstgroup that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.