Why Creo Medical (LON:CREO) fails the Piotroski F-Score

Even though Stockopedia's StockReports provide a wealth of financial data, filtering out the most dangerous stocks can be hard to do and takes time. That's why it's so useful to know a few numbers that say a lot about a company. This is what the Piotroski F-Score sets out to do.

Let's take Creo Medical Group as an example. Creo Medical Group plc is a United Kingdom-based medical device company focusing on the field of surgical endoscopy and other minimally invasive surgical devices. The group is still pre-revenue and reported an increase in net loss to £8.4m for the year to 30 June 2018. What jumps out as an immediate concern is that the group only has c£6.5m of cash on its balance sheet despite raising £20m halfway through 2017.

Unfortunately, what the F-Score algorithm says for Healthcare operator Creo Medical (LON:CREO) is not good. We'll get into this later, but first a bit more on what this number actually means.

Why Creo Medical (LON:CREO) shareholders need to know the Piotroski F-Score

When a stock gets beaten down it ends up in the bargain basement of the stock market. From here there are generally three outcomes. The stock either:

- Stumbles along

- Tumbles into administration, or

- Recovers emphatically

Stanford Finance Professor Joseph Piotroski wanted to sort the wheat from the chaff. After settling on the F-Score, he produced some astonishing results.

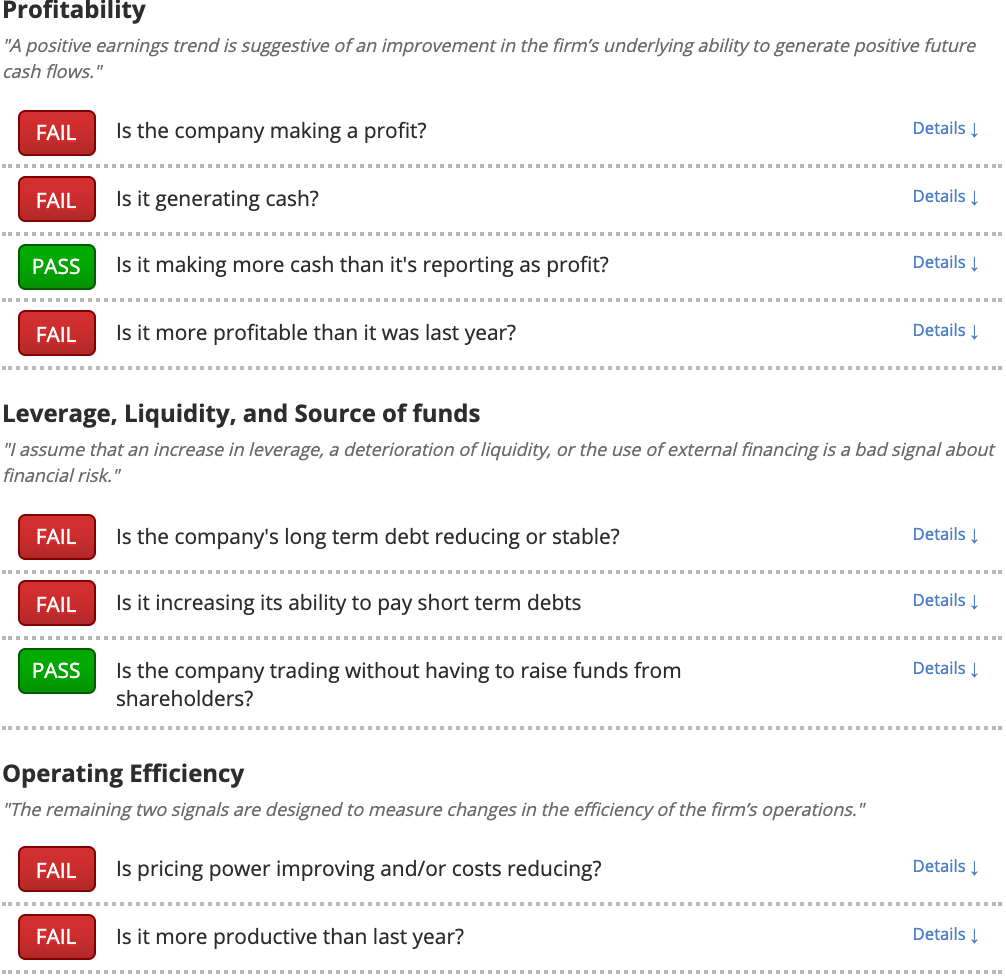

The Piotroski F-Score is a nine-strong checklist split up into three sections, each looking at a different part of a company's financial situation. Its secret sauce is that, unlike most ratios, the F-Score looks more deeply into the direction in which a company’s financial health is moving. Keeping on top of these trends can help us stay ahead of the game.

Piotroski found that weak stocks with an F-Score of 2 or less are five times more likely to either go bankrupt or delist due to financial problems. Working our way through Piotroski's checklist, we can see that Creo Medical gets a lowly F-Score of 2 out of a possible 9. Food for thought for anyone looking to hold onto their money.

Fortify your portfolio with simple, effective tools

The problem areas for Creo Medical identified here can be explored in more depth on Stockopedia's research platform. All the best investors have stringent due diligence processes that reduce the chances of them suffering big losses, so why not take a leaf out of their book?

Simple tools can help us better measure and understand the risks we take. That's why the Stockopedia team has been busy building new ways of understanding investment risks and company characteristics. In this webinar, we talk about two or our most popular innovations: StockRank Styles and RiskRatings. These indicators transform a ton of vital financial information into intuitive classifications, allowing you to get an instant feel for any company on any market - sign up for a free trial to see how your stocks stack up.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.