Why Fastjet's (LON:FJET) share price could fall further

Airlines can be a classic example of risk - take Fastjet (LON:FJET), the holding company of airlines including fastjet Airlines Limited (fastjet Tanzania) and fastjet Zimbabwe, for example. The fledgling airline operates approximately 10 routes to over 10 destinations in approximately six countries in Africa - an exciting investment story, no doubt.

But running an airline is expensive. For the six months ended 30 June 2018, Fastjet PLC revenues increased 42% to $30.1M but Net loss increased 11% to $14.6M and Basic Earnings per Share excluding Extraordinary Items increased from -$0.03 to -$0.02. Clearly the company needs cash and there is execution risk.

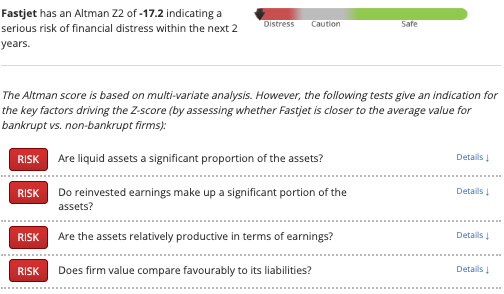

One method of assessing the financial safety of a company like fastjet is to apply the Altman Z-Score, which measures the degree to which a stock resembles companies that have gone bankrupt in the past. And what the Z-Score says about fastjet Plc might well be keeping the group’s chief financial officer, Michael Muller, up at night...

How the Altman Z-score works and why Fastjet shareholders should pay attention

The Altman Z-Score was developed by New York University finance professor and leading academic, Edward I. Altman. In 1968, the celebrated professor struck upon a combination of five weighted business ratios that is used by investment managers and hedge funds to this day.

Interpreting the Z-Score is simple. Any Z-Score above 2.99 is considered to be a safe company.

Those with a Z-Score of less than 1.8, on the other hand, have been shown to have a significant risk of financial distress within two years. As we mentioned earlier, numerous historical studies have shown the Z-Score to be an accurate predictor of imminent financial distress for those companies that score less than 1.8.

If we apply it to Fastjet (LON:FJET) what do we get? A (frankly horrendous) Z-Score of -17.2 - well below the cut-off point that signals potential distress...

Using the Z-Score to protect your portfolio

Here is where fastjet falls down:

Anthony Bolton, the well-regarded investment fund manager, once said: "When I analysed the stocks that have lost me the most money, about two-thirds of the time it was due to weak balance sheets. You have to have your eyes open to the fact that if you are buying a company with a weak balance sheet and something changes, then that’s when you are going to be most exposed as a shareholder." Using the Z-Score to identify and avoid this type of stock seems like a smart way to manage risk.

Next Steps

To find more stocks like Fastjet, you'll need to equip yourself with professional-grade data and screening tools to pinpoint the highest quality companies in the market. This kind of information has traditionally been closely guarded by professional fund managers. But our team of financial analysts have carefully constructed this screen - which gives you everything you need.

In less than a minute, you can be exploring a list of stocks with the very strongest financial ratios in the market. You'll be joining us on a journey towards owning the very best quality stocks possible. So what are you waiting for? Come and get started for free.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.