Why Hammerson's (LON:HMSO) dividend payment is in danger

Hammerson plc is a real estate investment trust (REIT) that owns, manages and develops retail destinations across Europe. In the UK, at least, this is proving troublesome - more retailers are migrating online and the casual dining scene is oversupplied, meaning there is downward pressure on rents and valuations. This concern over property valuations is reflected in the group's shares, which trade at just 0.47 tangible book value.

Set against that worrying backdrop, it is no surprise that Hammerson's revenues decreased 10% to £223.3M and the group plunged to a net loss of some £268.1m for the fiscal year ended 31 December 2018. Hammerson's rolling dividend yield of 6.90% may sound tempting, but is it safe?

One of the quickest ways to check is by looking at the dividend cover (earnings per share divided by dividend per share). Dividend cover is the inverse of the dividend payout ratio. Dividend cover of two times or above is strong. Anything below one and a half times - as is the case for Hammerson (LON:HMSO), requires further research.

Calculating Hammerson’s dividend cover ratio

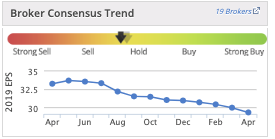

A low level of dividend cover means that a small decline in earnings could consign your dividend payment to the scrap heap. It happens all the time. We can see from the graphic below that Hammerson's 19 brokers have been revising down 2019 EPS estimates over the past few months:

With that in mind, let’s take a look at Hammerson’s (LON:HMSO) dividend cover. We can get all the information we need to see if Hammerson has an adequate level of dividend cover from the group’s StockReport. The group’s FY18 earnings per share is -34p and its FY18 dividend per share is 25.9p.

Due to the group's FY18 losses it has negative dividend cover for FY18. Even if we applied brokers' forecast FY19 EPS estimates to the current dividend, however, earnings would cover dividend payments just 1.13 times. This is below the 1.5 times cover limit that marks the point at which we should do some further digging on dividend sustainability and safety.

Income investing: what you need to know

For many investors, dividends are a vital part of their long-term strategy. That's why we have created a variety of income-focused stock screens, such as the Best Dividends Screen, to identify promising candidates for income portfolios. Take a look and see if any of the qualifying stocks might be worthy of further research.

If you’d like to discover more about dividend investing, you can read our free ebook: How to Make Money in Dividend Stocks.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.