Why the future looks bright for Bca Marketplace’s (LON:BCA) share price

In investing, knowing which numbers you should pay attention to and which you should discard is half the battle. Honing in on the measures that tell us what’s really going on can save us a lot of time and pain. It also allows us to move faster than the competition.

At Stockopedia, we strive to identify these key measures. One of the most useful we have found so far is Piotroski’s F-Score - and the F-Score has good news for shareholders of mid cap High Flyer Bca Marketplace (LON:BCA), which operates in the Consumer Cyclicals sector.

BCA Marketplace plc, formerly Haversham Holdings plc, owns and operates in the United Kingdom and Europe's used-vehicle marketplace with its We Buy Any Car brand. The Company operates through three divisions: UK Vehicle Remarketing, International Vehicle Remarketing and Vehicle Buying, offering a range of digital and physical pre and post-auction services.

Bca Marketplace (LON:BCA): strong recent performance

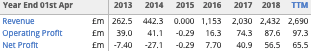

The group has been a strong performer recently, as shown in its five-year income history:

For the six months ended 30 September 2018, BCA Marketplace PLC revenues increased 22% to £1.43B and net income increased 35% to £34.9M. Given this encouraging financial performance, does its financial health match up?

Why we should pay attention to the Piotroski F-Score

Followers of celebrated accounting professor Joseph Piotroski are well aware of the checklist that made him famous at the turn of the millennium. Piotroski is behind the F-Score: a simple indicator to highlight stocks showing the most likely prospects for outperformance amongst a basket of neglected companies.

The great thing about the F-Score is that it is essentially an entire quality and fundamental momentum screen in a single number, succinctly summing up the financial health trend of a company. Applying it as a filter on top of almost any strategy can help to increase returns and reduce risk.

Bca Marketplace (LON:BCA)'s F-Score: what does it mean?

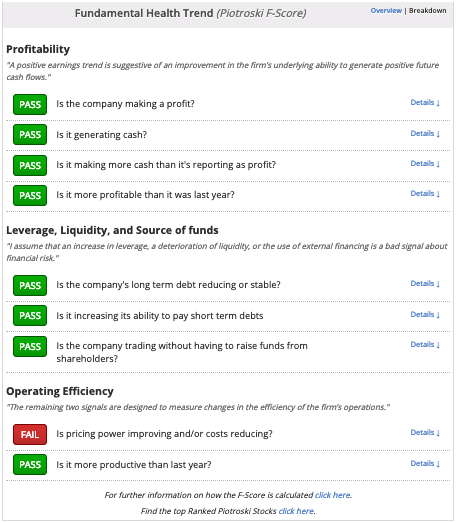

Bca Marketplace (LON:BCA) scores 8 out of a possible 9. In his landmark academic paper "Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers", Piotroksi showed that by investing in companies scoring 8 or 9 by these measures over a 20-year test period through to 1996, investor returns could be increased by an astounding 7.5% each year. Below, you can see exactly how LON:BCA stacks up against the checklist.

What does this mean for potential investors?

Bca Marketplace has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with Bca Marketplace that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.