Why the future looks bright for Fevertree Drinks' (LON:FEVR) share price

The best companies compound investment returns at consistently above-average rates over the long term. These stocks are different because they've got what billionaire investor Warren Buffett, calls economic moats. These moats can be divided into different types:

- Intangible Assets - Such as brands that customers love, valuable patents or regulatory approvals

- Switching Costs - It might be too costly, complicated or unnecessary for customers to look elsewhere

- Network Effects - When customers become part of a product it creates tremendously powerful businesses

- Cost Advantages - Superior processes and unique locations and assets make it hard for others to compete

- Great Scale - Large infrastructure and distribution networks are powerful barriers to entry in many industries

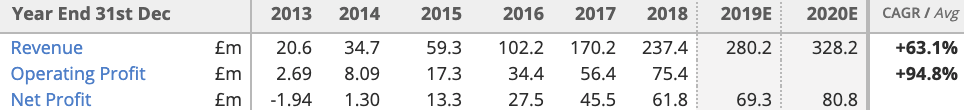

Fevertree Drinks (LON:FEVR) is a large cap Beverages stock. The Company sells a range of products under the Fever-Tree brand to hotels, restaurants, bars and cafes, as well as supermarkets. It has been growing at a staggering pace over the past five years, as we can see below:

From 2017 to 2018 alone, revenues increased 40% to £237.4m and net profit jumped 36% to £61.8m. With its shares currently trading at 43.6 times forecast earnings, the company needs to maintain this growth in the years ahead if it hopes to satisfy shareholders.

Has Fevertree Drinks LON:FEVR) got a moat

Some of the biggest indicators of a moat involve persistent strong margins and high levels of cash generation. Here are a few ways of gauging these characteristics - and how Fevertree Drinks compares:

- High rates of Free Cash Flow - the measure of a thriving company.

- A high ratio of free cash flow to sales can be a very positive sign. For Fevertree Drinks, the figure is an impressive 18.6%. - High Return on Capital Employed - the measure of a company growing efficiently and profitably.

- A 5-year average ROCE of more than 12 percent is a pointer to strong efficiency. For Fevertree Drinks, the figure is an eye-catching 30.9%. - High Return on Equity (compared to peers) - the measure of a company making good profits from its assets.

- Fevertree Drinks has a 5-year average ROE of 28.8%. - High Operating Margins (compared to peers) - the measure of a company with pricing power

- Fevertree Drinks has a 5-year average operating margin of 30.2%.

What does this mean for potential investors?

Some of the best quality stocks in the market have defensible models that can deliver high levels of shareholder returns over the long term. But there are no guarantees and it's important to do your own research. Indeed, we've identified some areas of concern with Fevertree Drinks that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.