Will Science In Sport's (LON:SIS) share price suffer because of its poor F-Score?

It's hard to keep tabs on hundreds of companies, but that's what we have to do if we want to find overlooked investment opportunities. Sometimes there just isn't time to dig through the annual accounts of multiple companies, however.

Thankfully there are measures like the Piotroski F-Score, which distill a wealth of financial data into one easily comparable score. Unfortunately, what the F-Score algorithm says for Consumer Defensives operator Science In Sport (LON:SIS) is not good. First a little bit more on what this number means.

What the Piotroski F-Score says about Science In Sport (LON:SIS)

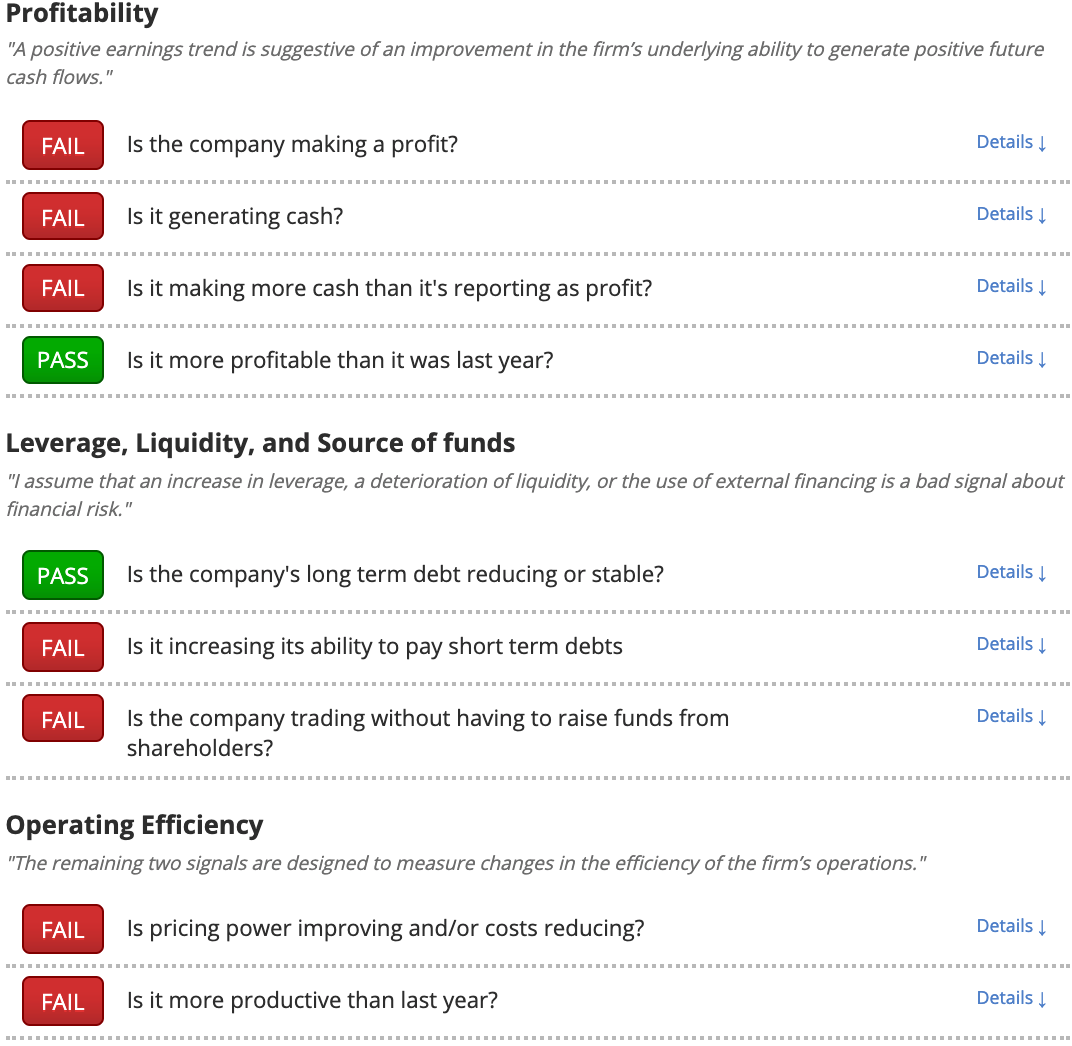

The Piotroski F-Score is a nine-strong checklist split up into three sections, each looking at a different part of a company's financial situation. Unlike most ratios, the F-Score looks more deeply into the direction in which a company’s financial health is moving.

Piotroski found that weak stocks with an F-Score of 2 or less are five times more likely to either go bankrupt or delist due to financial problems. Working our way through Piotroski's checklist, we can see that Science In Sport (LON:SIS) gets a lowly F-Score of 2 out of a possible 9...

This means that not only is Science In Sport financial health deteriorating, it currently fits in with the stocks that Piotroski identified as being five times more likely to go bankrupt or delist.

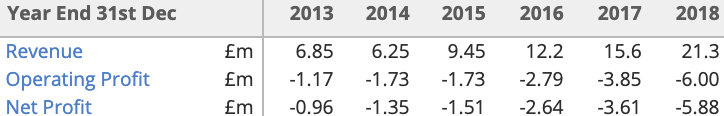

Looking at the group's recent financial results, we can see that for the fiscal year ended 31 December 2018, Science in Sport PLC revenues increased 37% to £21.3m but Net loss increased 63% to £5.9m. The group has been loss-making ever since its flotation, although revenue has been growing at pace.

That said, Science in Sport has had to raise money from shareholders almost every year since its IPO and, if its one-year relative strength of -33.4% is anything to go by, there are signs that patience may be running thin.

Fortify your portfolio with simple, effective tools

The problem areas for Science in Sport identified here can be explored in more depth on Stockopedia's research platform. All the best investors have stringent due diligence processes that reduce the chances of them suffering big losses, so why not take a leaf out of their book?

Simple tools can help us better measure and understand the risks we take. That's why the Stockopedia team has been busy building new ways of understanding investment risks and company characteristics. In this webinar, we talk about two or our most popular innovations: StockRank Styles and RiskRatings. These indicators transform a ton of vital financial information into intuitive classifications, allowing you to get an instant feel for any company on any market - sign up for a free trial to see how your stocks stack up.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.