This is #1 in our "Twelve Stocks of Christmas 2025" Series. You can review the full set here.

The Pitch

City of London Investment (LON:CLIG) is a specialist asset manager with a focus on emerging markets, fixed income and closed-end funds. The rampant outperformance of the Mag 7 and US market have made life tough in recent years, but CLIG’s strategies have performed notably over the last 12 months. A strong cash balance sheet and near-9% yield help to limit the downside, while a StockRank of 96 hints at the potential for a re-rating if CLIG can achieve a return to reliable net inflows.

The Big Picture

CLIG has a long pedigree as a founder-led business. While the company’s original founder retired a few years ago, a merger with a similar-sized US firm meant that a new owner, George Karpus, took over the top rung of the shareholder register with a 30%+ holding. Karpus has been vocal in calling for improvements and there’s evidence these efforts have started to bear fruit. At the same time, market conditions have become more favourable over the last year as CLIG’s core emerging markets universe has performed more strongly.

Why now? Active asset managers have struggled against the passive onslaught and outperformance of the S&P 500. But conditions may be changing. The S&P has lagged the FTSE 100 over the last 12 months, while CLIG’s flagship equity strategies delivered gains of more than 20% during the year to 30 June 2025.

Fresh leadership: long-serving CEO Tom Griffith left recently. Pressure from Mr Karpus is likely to help ensure his replacement has a sharper focus on operational excellence and marketing delivery.

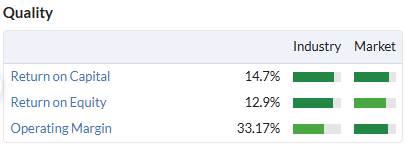

Why CLIG: there are other asset managers out there with attractive metrics. But few of them have CLIG’s combination of 30%+ operating margins, balance sheet strength, founder alignment. Very few also have a dividend that’s not been cut for 20 years and offers a near-9% yield.

Going Deeper

CLIG’s profitability and shareholder-friendly dividend are not in question.

What is still unproven is the company’s ability to achieve a return to sustainable net inflows. The last year has seen improved investment performance from CLIG’s assets, suggesting its niche strategy of seeking value in closed-end…