Prologue

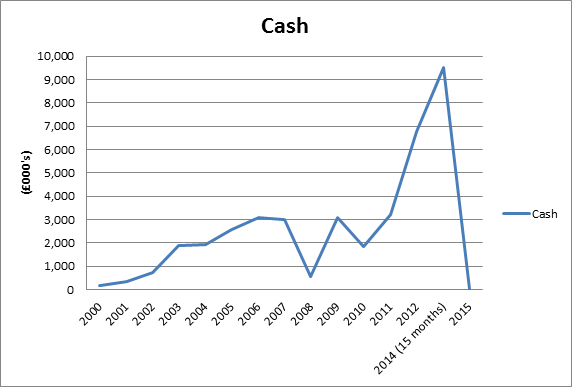

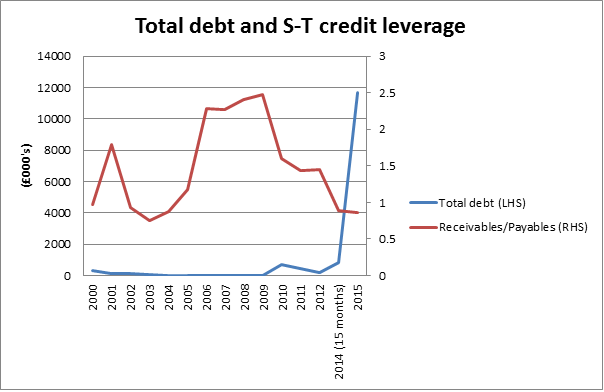

Stanley Gibbons had a record cash balance of £9.5m in 2014, a year later it had zilch! At the same time, total debt went from under £1m to £12m.

Why the change of fortune?

Ever since 2012, the company went bargain-hunting, spending a total of £60m and tripling its assets based. However, it added only £20m in sales (60% increases from pre-acquisitions).

Recently, management released two profits warnings and investors’ response was to send the stock tumbling by more than 60%.

Broker Peel Hunt expected earnings for 2015 to reach £7.5m. Instead, it came under £2m!

Why is Stanley Gibbons in trouble?

As a rare antique dealer, operations are likely to be ‘volatile’ because they don’t have a consistent stream of buyers, so performance will overshoot, or underperform.

In this case, the business has severely under-performed.

1. Decline in earnings

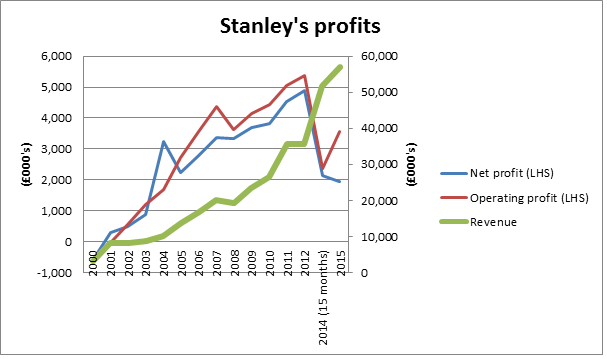

In the Income statement, Stanley Gibbons earnings are suffering and operational costs (see below) are out of control.

The increase in revenue should mean higher profits level, but due to integration issues costs got out of control as elevating expenses hurt margins.

Source: Stanley Gibbons’ annual reports

2. No cash!

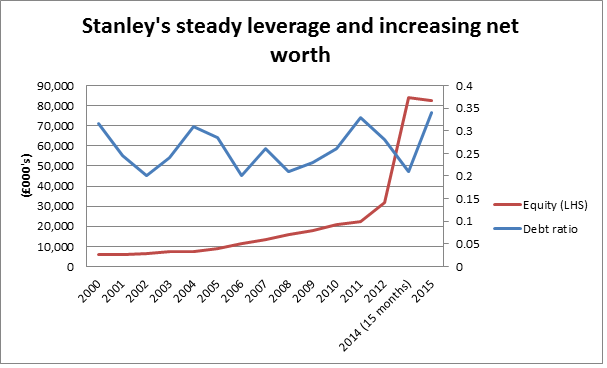

Looking at their Balance Sheet, one would see increasing shareholders’

value and a stable debt ratio.

Source: Stanley Gibbons’ annual reports

But underneath the ‘so-called’ stable debt ratio and

exploding shareholders’ value, the business doesn’t have a ‘single penny’ to its name.

Source: Stanley Gibbons’ annual reports

This poses a set of problems, especially when management has downgraded Stanley’s outlook for next year. There’s a high probability of the business borrowing more money before things can turn around.

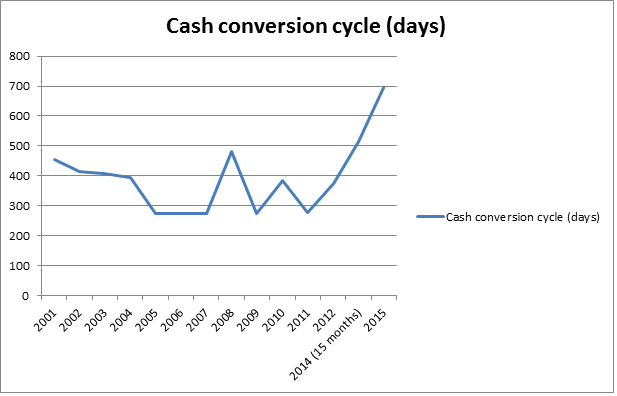

3. Waiting

for ‘antiques’ to turn into cash!

Source: Stanley Gibbons’ annual reports

Inventories’ conversion has risen from a historic 350-400 days to 700 days. It reinforces the needs for the company to raise cash, as cash inflows are taking longer to cover immediate cash expenses.

A second problem is write downs on the company’s inventories because the business is not converting short-term assets into cash, as demand is lacklustre.

4. Increasing financial risks

I don’t want to sound like a broken record, but Stanley

Gibbons is likely to press the ‘external fundraising’.

Source: Stanley Gibbons’ annual reports

With £12m in debt, along…